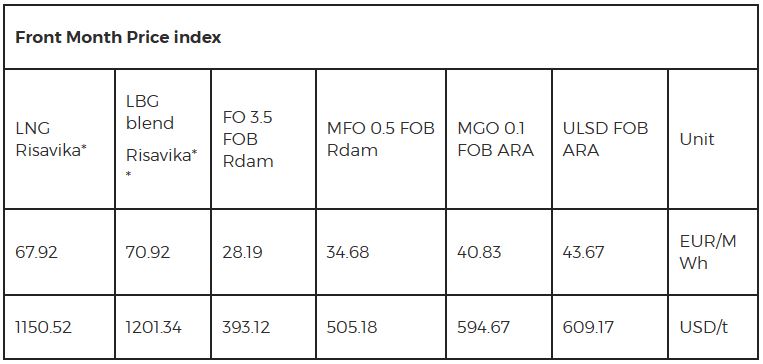

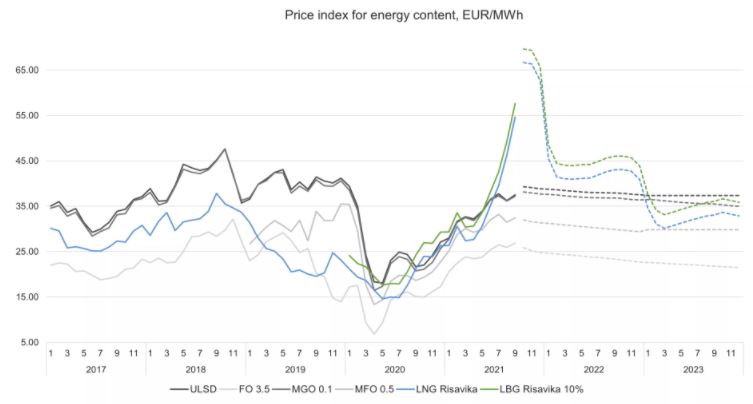

Risavika LNG index was up 12 % in two weeks, reaching 67.92 EUR/MWh for October contracts. The sentiment in the market is bullish on likely delay of Nord Stream 2 (NS2) supplies despite its completion. German energy regulator Bnetza has until early January to reach and publish a draft decision on the 55 bcm NS2 developer’s application to act as the line’s operator, with a final decision not likely until summer 2022. Accompanied with current low pipeline supplies from Norway and Russia, low LNG arrivals and low storage stocks across the Northwest Europe, the prices could gain more depending on the heating demand next month.

Oil product prices were mostly sideways for the last two weeks supported by hurricane season in the US. Fuel oil 3.5 (FO 3.5) price has dropped 0.3 % to 393.12 USD/t, low sulphur oil (MFO 0.5) gained 0.5 % to 505.18 USD/t and marine gasoil (MGO 0.1) increased by 0.6 % to 594.67 USD/t. Oil products prices could gain in short-term as hurricane Nicholas was heading towards oil facilities in Texas, which could impact production of crude and refineries run.

Despite this year spike in prices, shipowners are considering long-term perspective. According to DNV’s recent Maritime Forecast to 2050, the energy and technology transition in shipping has started with nearly an eighth (12%) of current newbuilds ordered with alternative fuel systems. This was an increase from the 6% reported in the 2019 edition. Except for the electrification underway in the ferry segment, the alternative fuels are currently dominated by LNG. The trend is likely to continue until e until regulations tightens in 2030 or 2040 depending on the decarbonization pathway. DNV’s model shows uptake of carbon-neutral fuel picking up in the late 2030s or mid-2040s, reaching between 60% and 100% of the fuel mix in 2050.

LNG Risavika – LNG FOB Risavika

LBG Risavika 10 % – 10 % blend of Liquified Biogas

FO 3.5 FOB Rdam – European 3.5% Fuel Oil Barges FOB Rdam (Platts) Futures Quotes

MFO 0.5 FOB Rdam – European FOB Rdam Marine Fuel 0.5% Barges (Platts) Futures Quotes

MGO 0.1 FOB ARA – Gasoil 0.1% Barges FOB ARA (Platts) Futures Quotes

ULSD FOB ARA – European Diesel 10 ppm Barges FOB ARA (Platts) Futures Quotes

Source: CME Group, Gasum, Argus Media, DNV

*An estimate for LNG FOB Risavika

** An estimate for 10 % LBG blend FOB Risavika

Source: GASUM