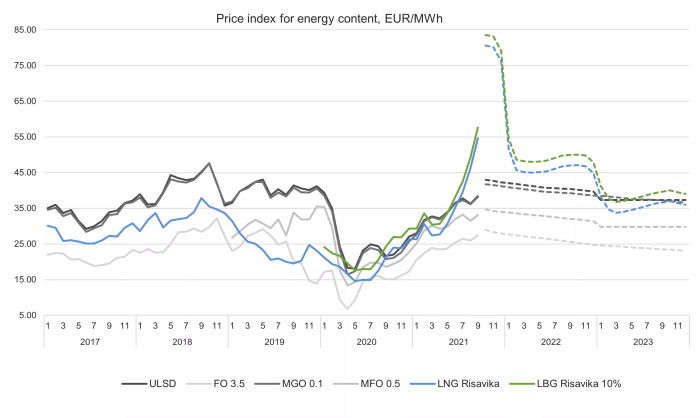

Risavika LNG index was up 6.4 %, reaching 80.24 EUR/MWh for October contracts. With Russian flows remaining unchanged, slow LNG and low storage levels at the start of winter season, October gas prices gained additional support. European gas storage levels are at their lowest in at least 10 years ahead of this winter heating season, adding to the risk of further price increase. European storage sites are around 72% full, compared with 94% full at the same time last year, and 85% full on average over the past 10 years by the end of September, according to Reuters. European gas markets are likely to be volatile and bullish this winter season, and the weather will play a major role on supply and demand balance.

Oil product prices were up on tight supply and drawdown in US and European inventories. Fuel oil 3.5 (FO 3.5) price has gained 6.9 % to 425.67 USD/t, low sulphur oil (MFO 0.5) and marine gasoil (MGO 0.1) gained 2.2 % and 3.9 % to 530.74 USD/t and 641.04 USD/t respectively week on week. Brent benchmark has been trading above 80 USD/BBL on Monday as market anticipates tighter supply, while demand recovery continues. The return of US crude production after the hurricane season has been slow so far. More than 16 % or 294 400 BBL/D of offshore production in the region remained shut in as of 23 September, according to the Bureau of Safety and Environmental Enforcement.

Source: GASUM