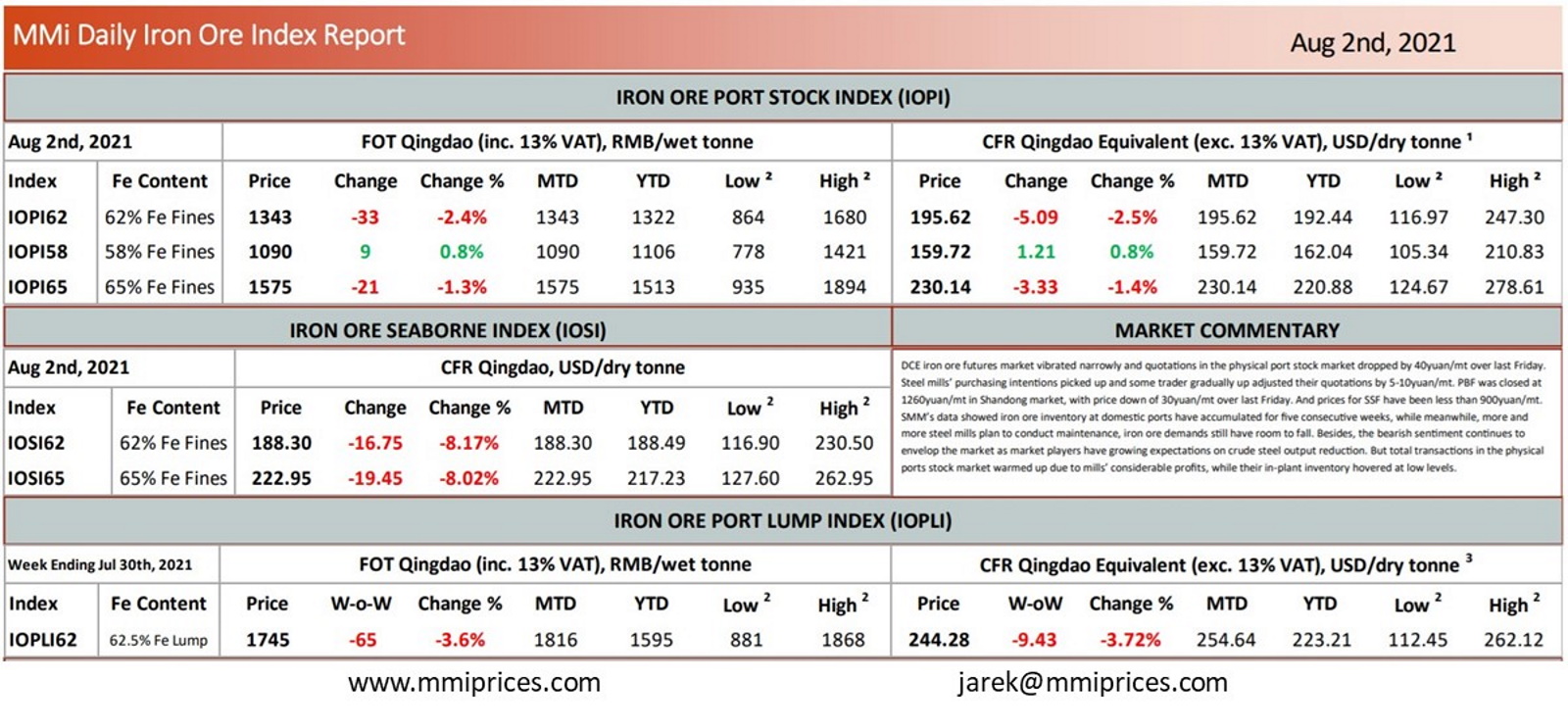

DCE iron ore futures market vibrated narrowly and quotations in the physical port stock market dropped by 40yuan/mt over last Friday. Steel mills’ purchasing intentions picked up and some trader gradually up adjusted their quotations by 5-10yuan/mt. PBF was closed at 1260yuan/mt in Shandong market, with price down of 30yuan/mt over last Friday. And prices for SSF have been less than 900yuan/mt. SMM’s data showed iron ore inventory at domestic ports have accumulated for five consecutive weeks, while meanwhile, more and more steel mills plan to conduct maintenance, iron ore demands still have room to fall. Besides, the bearish sentiment continues to envelop the market as market players have growing expectations on crude steel output reduction. But total transactions in the physical ports stock market warmed up due to mills’ considerable profits, while their in-plant inventory hovered at low levels.

Source: Metals Market Index (MMi)