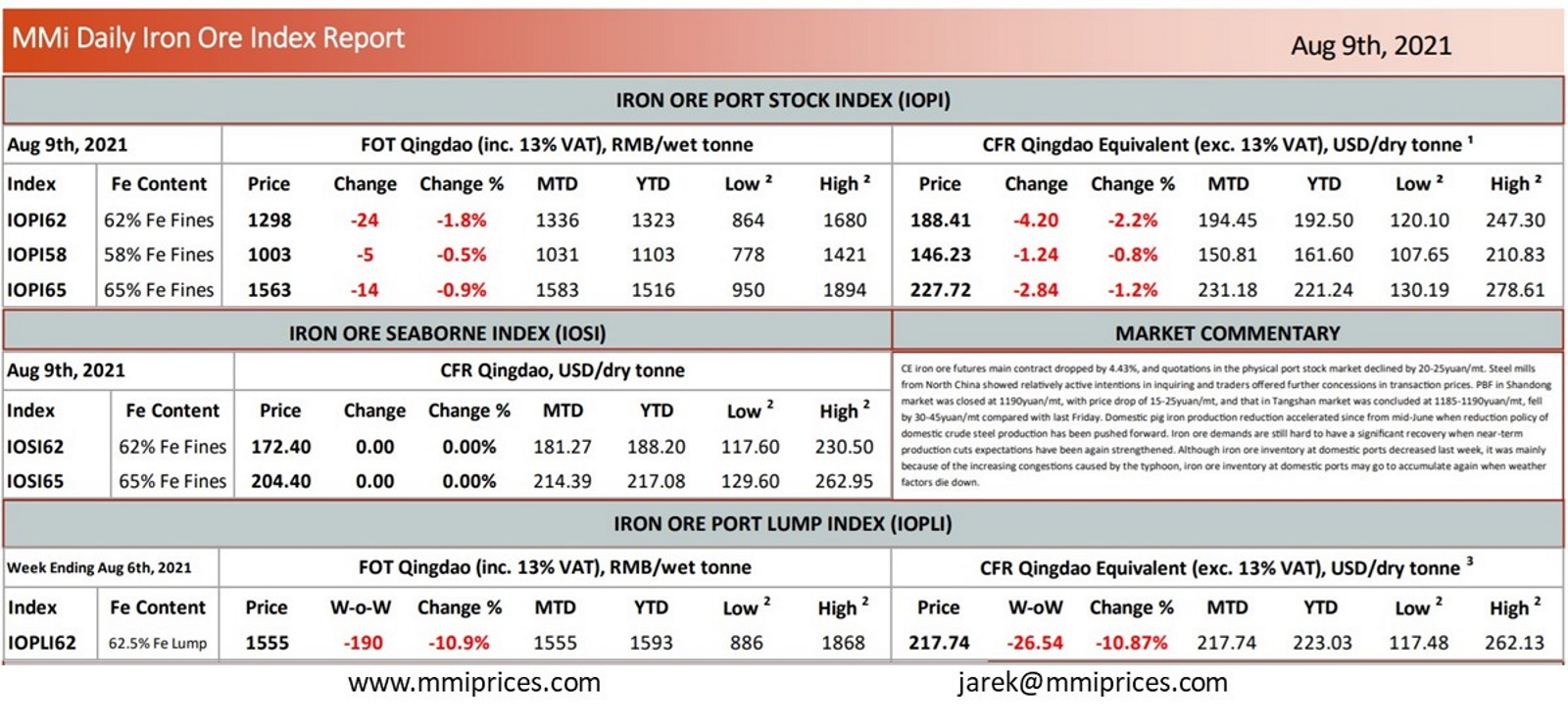

CE iron ore futures main contract dropped by 4.43%, and quotations in the physical port stock market declined by 20-25yuan/mt. Steel mills from North China showed relatively active intentions in inquiring and traders offered further concessions in transaction prices. PBF in Shandong market was closed at 1190yuan/mt, with price drop of 15-25yuan/mt, and that in Tangshan market was concluded at 1185-1190yuan/mt, fell by 30-45yuan/mt compared with last Friday. Domestic pig iron production reduction accelerated since from mid-June when reduction policy of domestic crude steel production has been pushed forward. Iron ore demands are still hard to have a significant recovery when near-term production cuts expectations have been again strengthened. Although iron ore inventory at domestic ports decreased last week, it was mainly because of the increasing congestions caused by the typhoon, iron ore inventory at domestic ports may go to accumulate again when weather factors die down.

Source: Metals Market Index (MMi)