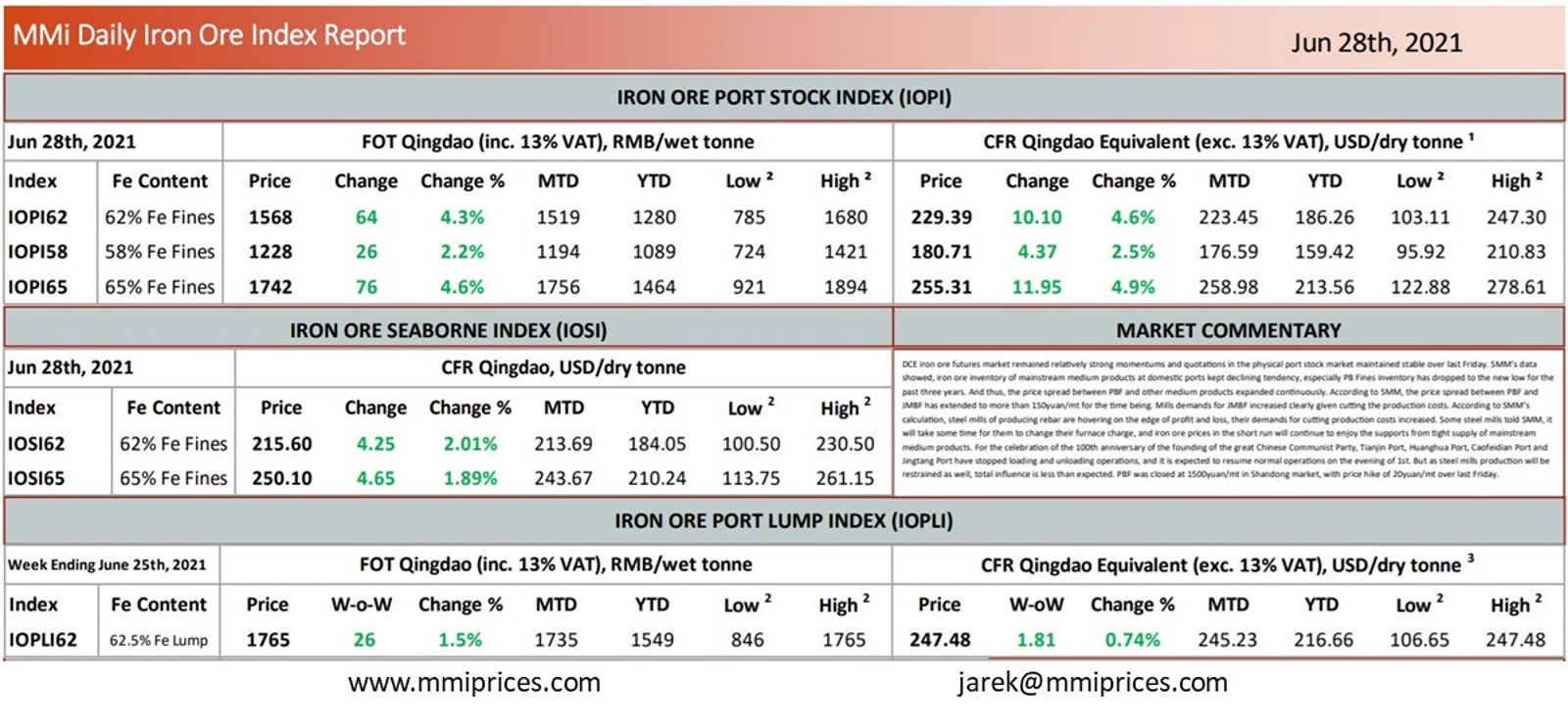

DCE iron ore futures market remained relatively strong momentums and quotations in the physical port stock market maintained stable over last Friday. SMM’s data showed, iron ore inventory of mainstream medium products at domestic ports kept declining tendency, especially PB Fines inventory has dropped to the new low for the past three years. And thus, the price spread between PBF and other medium products expanded continuously. According to SMM, the price spread between PBF and JMBF has extended to more than 150yuan/mt for the time being. Mills demands for JMBF increased clearly given cutting the production costs. According to SMM’s calculation, steel mills of producing rebar are hovering on the edge of profit and loss, their demands for cutting production costs increased. Some steel mills told SMM, it will take some time for them to change their furnace charge, and iron ore prices in the short run will continue to enjoy the supports from tight supply of mainstream medium products. For the celebration of the 100th anniversary of the founding of the great Chinese Communist Party, Tianjin Port, Huanghua Port, Caofeidian Port and Jingtang Port have stopped loading and unloading operations, and it is expected to resume normal operations on the evening of 1st. But as steel mills production will be restrained as well, total influence is less than expected. PBF was closed at 1500yuan/mt in Shandong market, with price hike of 20yuan/mt over last Friday.

Source: Metals Market Index (MMi)