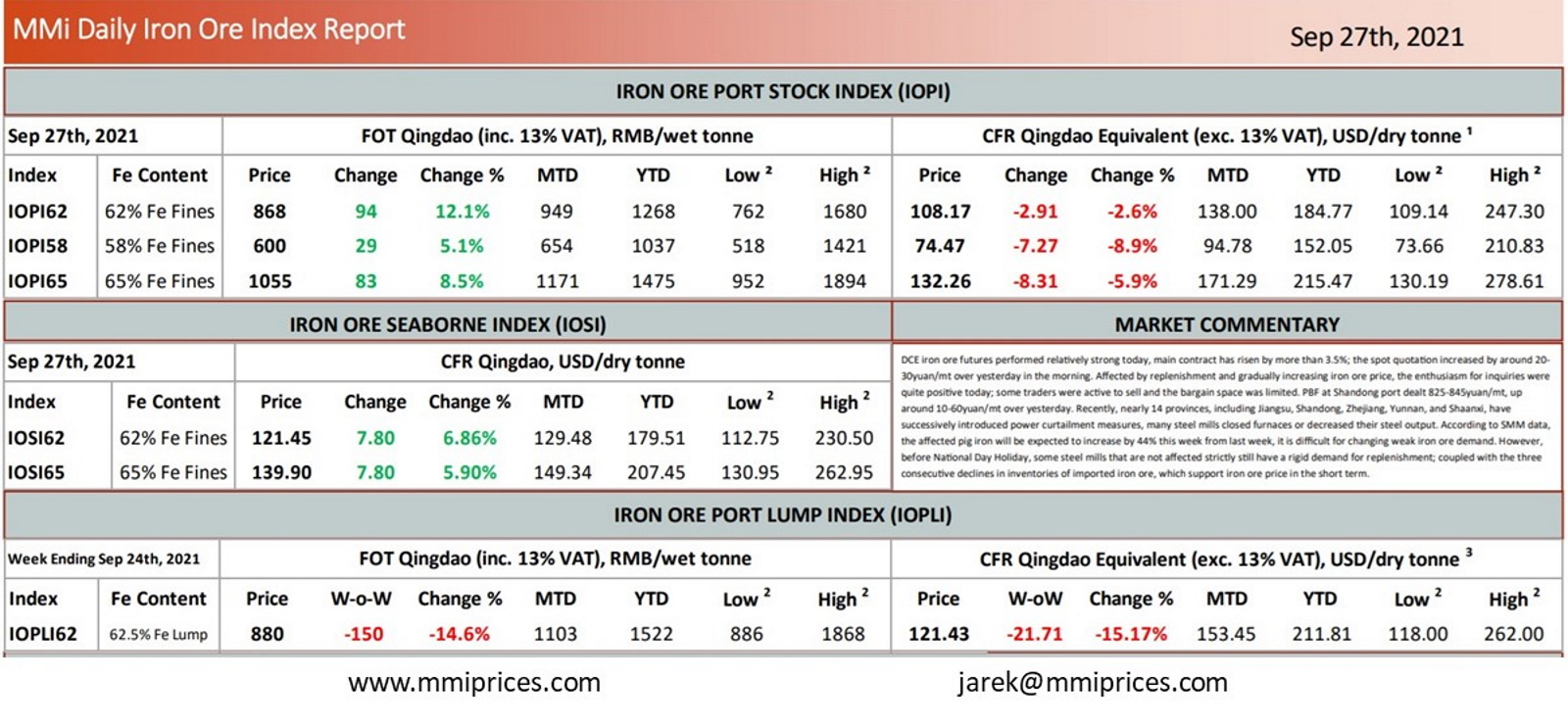

DCE iron ore futures performed relatively strong today, main contract has risen by more than 3.5%; the spot quotation increased by around 20- 30yuan/mt over yesterday in the morning. Affected by replenishment and gradually increasing iron ore price, the enthusiasm for inquiries were quite positive today; some traders were active to sell and the bargain space was limited. PBF at Shandong port dealt 825-845yuan/mt, up around 10-60yuan/mt over yesterday. Recently, nearly 14 provinces, including Jiangsu, Shandong, Zhejiang, Yunnan, and Shaanxi, have successively introduced power curtailment measures, many steel mills closed furnaces or decreased their steel output. According to SMM data, the affected pig iron will be expected to increase by 44% this week from last week, it is difficult for changing weak iron ore demand. However, before National Day Holiday, some steel mills that are not affected strictly still have a rigid demand for replenishment; coupled with the three consecutive declines in inventories of imported iron ore, which support iron ore price in the short term.

Source: Metals Market Index (MMi)