The renewal process of the global fleet has picked up pace in 2021, after a lackluster couple of years. In its latest weekly report, Clarkson Platou Hellas said that “in tankers, STX Jinhae have announced a plethora of deals this week. The yard has signed six firm 50k dwt MR’s with an unknown owner, with deliveries to begin in 2Q 2023 and run through until the end of 2023. STX also signed contracts for two firm plus two optional 115k dwt Aframax’s, also with an unknown owner and deliveries of the firm vessels set for 1H 2023. Finally at STX, they signed for two firm 10k dwt Chemical tankers, again with an unknown owner, with delivery expected within 2023. In other tanker news, Proman Shipping announced signing for a further two firm 50k MRs, with delivery of both vessels set for 4Q 2023, bringing the series to six overall”.

It was also a very busy week in the dry bulk market. According to Clarkson Platou Hellas, “Wisdom Marine Group announced signing for three firm 82k dwt Kamsarmax at Tsuneishi Zhoushan, with delivery of all three vessels set for 2023. Yangzijiang announced contracting two firm 82k Kamsarmax for an unknown owner, with delivery of both vessels expected in 1H 2023 and the vessels to be constructed at their Yangzi Mitsui facility. Onomichi Dockyard are reported to have agreed two firm 40k dwt Handysize bulkers with Wisdom Marine Group, with delivery expected within 2023. Onomichi are also reported to have contracted three firm 37k dwt Handysize bulkers with an unknown owner, with deliveries set for 2023.

The yard also took order for three firm 37k dwt Handysize bulkers, with a different unknown owner, with deliveries of all three vessels once again set for 2023. Chengxi Shipyard announced committing to build six firm 64k Chip carriers with BoCom Leasing, with deliveries set for, three vessels in 2023 and the remaining vessels in 2024. The yard also contracted two firm 70k dwt Chip carriers, again for BoCom leasing, with delivery of the first vessel in 2023 and the second vessel in 2024. In the gas carrier market, Hyundai Samho announced contracting two firm 86k CBM DF VLGCs with an unknown owner, with delivery of the first vessel expected sometime in 2Q 2023 and the second vessel in September 2023. Samho also contracted a firm 174k CBM LNG carrier, again with an unknown owner, with the vessel to be delivered in November 2023”, the shipbroker noted.

Additionally, “in containers, the largest order this week came from HMM, who placed two separate orders for 12 firm 13,000 TEU Containerships overall. HMM ordered six firm 13,000 TEU vessels at Daewoo (DSME), with the vessels all said to be scrubber fitted and LNG ready, with delivery slated to take place through 1H 2024. They ordered another six firm 13,000 TEU vessels at Hyundai HI, again with delivery expected throughout 1H 2024. Sesapan Corporation announced a deal at Yangzijiang for six firm 15,000 TEU containerships, with delivery set to take place throughout 1H 2024. Wan Hai Lines revealed they had ordered 12 firm gearless 3,055 TEU boxships at JMU, with deliveries expected throughout 2H 2023 and 1H 2024. Continuing in containers, Ningbo Ocean Shipping reportedly contracted three firm domestic trading 3,300 TEU vessels at Yangzijiang, with deliveries expected within 2023. Ningbo Ocean Shipping also ordered three firm gearless 1,400 TEU vessels at Penglai Jinglu, with delivery again reportedly in 2023. Shanghai Jinling Shipping ordered two firm plus two optional gearless 1,900 TEU containerships at Zhejiang Yangfan, with the firm vessels to be delivered in 2023. Hyundai Mipo announced signing for three firm gearless 1,800 TEU vessels with an unknown owner, with delivery of all three vessels set to take place in 1Q 2023. Hyundai Mipo also announced contracting two firm gearless 1,800 TEU vessels with clients of Euroseas, with delivery expected in 1Q and 2Q 2023. Finally, Maersk announced signing for a firm gearless 2,100 TEU boxship, again at Hyundai Mipo. The vessel is methanol dual fuel and is to be delivered within mid-2023. Finally, the big news in the ferry market was that Kiwirail finally signed their long-discussed project for two firm 220 LOA, battery hybrid Ropax’s at Hyundai Mipo, with the vessels to be delivered in 2025 and 2026 respectively”, Clarkson Platou Hellas concluded.

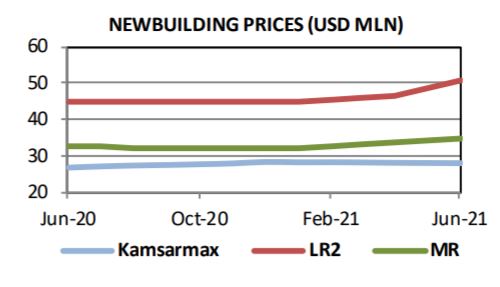

In a separate note, shipbroker Banchero Costa said that “Canadian owner Seaspan placed an order at New Yangzijiang for 6 x NeoPanamax units (abt 15,000 teu), price around $100 mln each with deliveries during 2024. In South Korea Hyundai Mipo received an order from Euroseas for 2 x 2,824 teu container units. The vessels are scheduled during the second half of 2023 and the 1st half 2024. Wisdmom Marine signed with Tsuneishi Zhoushan 3 x Kamsarmax units for deliveries during 2023. The vessels price is reported to be around $34 mln per unit. In China, Chengxi Shipyard received an order from Bank of Communications Financial Leasing to build 8 x Woodchip carries (6 units to be geared 64,000 dwt and 2 units to be gearless around 70,000 dwt), deliveries during 2023/2024. These vessels will be employed on a long term TC with Nine Dragons Paper Holding for 15 years and the price is $39 mln each. Cadeler, ordered 2 x Windmill Turbine Installation Vessel at Cosco Shipping Heavy Industry, Qidong, with deliveries in 3Q2024 and 1Q2025. The total contract price is reported to be at $651 mln”, the shipbroker concluded.

Nikos Roussanoglou, Hellenic Shipping News Worldwide