After Russia’s President Vladimir Putin met US President Joe Biden in Geneva last week, he had some warm-ish words for his American counterpart. “Mr Biden is a professional,” Putin said. “He is focused, he knows what he wants to achieve and does it very skilfully.” He could afford to be generous, perhaps, because Russia is coming close to achieving one of its key energy policy objectives, completing the Nord Stream 2 gas pipeline to Germany, in the face of US opposition.

The new pipeline will help support an expected steep increase in Russian gas exports to Europe next year. But one concern underlying US opposition to Nord Stream 2 — the threat to Europe’s position as a market for its LNG exports — seems likely to be less serious than it initially appeared. The European gas market has been changing fast, and there is scope for imports of both Russian gas and LNG to increase in 2022.

Nord Stream 2 had initially been expected to come into service early in 2020. US sanctions have helped delay it by almost two years, but it is now on course for starting commercial operations late this year. Pipe-laying for one of the project’s two lines was completed at the beginning of June. The second line is expected to be complete within the next three months, and then commissioning work and certification will need to be done before commercial operations can begin.

The Biden administration argues that it is not a practical proposition to try to stop these final steps. Anthony Blinken, the US secretary of state, said at a confirmation hearing in January that he was “determined to do whatever we can” to prevent Nord Stream 2 being finished.

This month, however, he told the House foreign affairs committee that its completion was a “fait accompli”. US sanctions imposed in 2019 meant that the Swiss company Allseas had to stop working on the project, but its vessels have been replaced by two Russian-flagged pipe-laying ships that have been able to continue the work. In May, the US state department told Congress that it would waive sanctions against the Switzerland-based Nord Stream 2 AG project company, a Gazprom subsidiary, and its chief executive Matthias Warnig.

The most significant remaining issue the pipeline faces is that it will have to comply with Europe’s gas directive amendment. This will require unbundling of ownership, third party access, and a regulated tariff on the 54 kilometre stretch of pipeline in German territorial waters.

Market conditions have been making the point to European consumers that additional import capacity would be helpful. European gas prices have risen sharply over the past 12 months. A year ago, the benchmark TTF futures contract for the fourth quarter of 2021 was trading at about €14 per megawatt hour, or roughly US$4.90 per million British thermal units. This week, that contract went above €31.70 per MWh, or about US$11.1 per million BTU.

The key factor behind the increase has been the doubling of coal and carbon prices since the start of last winter. That has lifted the price at which it makes sense to switch from coal to gas for power generation by about US$3.50 per million BTU for this coming winter. The price of EU carbon emission allowances in the European emissions trading system has doubled from about €25 per tonne of carbon dioxide equivalent last October, to over €50 per tonne this week.

The completion of Nord Stream 2, which will have a capacity of 55 billion cubic metres per year, will help Russian gas sales to Europe leap higher. Wood Mackenzie is forecasting that European imports of Russian gas will jump by about 12%, from 176 bcm this year to 196 bcm in 2022. That would be a new record, exceeding the previous peak in 2018.

However, that need not mean that LNG sales in Europe are squeezed out. Europe’s own gas production is declining, as are imports from North Africa, while demand is rising, and that is creating opportunities for other suppliers. If some way is found to stop Nord Stream 2 at the last moment, US and other LNG exporters would be among the main beneficiaries. But even if the pipeline does go ahead, the European LNG market is set to grow next year. We are forecasting that European LNG imports will increase from 105 bcm this year to 114 bcm in 2022.

The longer-term trends look positive for LNG imports, too. Emissions allowance prices will be underpinned by the EU’s plans for rapid decarbonisation over the coming decade, supporting a continued shift away from coal for power generation, and Wood Mackenzie expects European gas demand to remain resilient. Meanwhile, production is expected to continue to decline.

The Biden administration drew strong criticism from Republican members of Congress over its decision that the battle to stop Nord Stream 2 was no longer worth the cost. “Lifting these sanctions… prioritizes Russian energy over American energy and Russian jobs over American jobs,” they wrote. It is true that the position of US LNG exporters will be less favourable than it would have been if the pipeline had been stopped. But with European LNG imports set to grow into the 2030s, US exporters should be able to increase sales over time, despite the existence of Nord Stream 2.

As Murray Douglas, Wood Mackenzie’s research director for gas in Europe, puts it: “As local production continues to fall away while demand continues to strengthen, there is space for both.”

Battery storage shows its value in California

For many years the importance of battery storage for backing up variable solar and wind power has been discussed as theoretical point. In California this year, it is becoming a reality. Last Saturday evening, solar power output was dwindling as the sun set, but the south of the state was still sweltering in the heatwave that had sent temperatures well above 100 °F (about 38 °C) in some places. At that point, the power supplied from battery storage rose to a new record high for California’s grid, hitting an hourly average of 637 megawatts between 7pm and 8pm, Wood Mackenzie data show. It would an exaggeration to say it was batteries that kept the lights on, but they certainly made an important contribution.

That contribution has increased about five-fold since last summer. In August 2020, when California’s grid operator CAISO was forced into rolling blackouts on a couple of days, battery storage contributed an hourly maximum of 128 MW. Since then, a number of new facilities have opened, including the 300 MW / 1200 MW hour Phase 1 of Vistra’s Moss Landing Energy Storage Facility, the world’s largest battery energy storage system. The maximum output from all the batteries on the California grid today is about 1.1-1.2 gigawatts, Wood Mackenzie analysts estimate, so the contribution could be even greater if the need for additional supply becomes urgent.

Backing up variable renewables is not the only use case for batteries on the grid, which can also provide ancillary services such as frequency regulation. But it does have the highest profile. With last year’s blackouts fresh in Californians’ memories, and alerts issued last week urging customers to conserve power, the value of energy storage is being made clear.

“Storage is now making a significant contribution to California’s grid,” says JP McMahon, a Wood Mackenzie power market analyst. “It might not be enough to avoid blackouts if a few large units go offline, but it could potentially replace a 600 MW gas plant.”

That contribution from batteries is set to grow rapidly over the next few years. Wood Mackenzie forecasts show total battery discharge power capacity on the grid in California rising almost four-fold from about 2.7 GW at the end of this year to 10.6 GW by 2026, even without an extra push from a federal carbon price. By the middle of the decade, California is expected to have more supply capacity in batteries than in gas peaking plants.

Before then, there will be another difficult summer to get through. The rule of thumb is that California’s grid comes under severe strain and may have to begin load-shedding when demand rises over 45 GW. Peak demand this summer is projected at about 45.8 GW: lower than last year, but still high enough to cause problems. The National Weather Service has warned of “a potential historic heat wave” in the western US this weekend, centred on Oregon and also affecting northern California. Meanwhile, the severe drought is hitting California’s hydro power production.

Although the heavy investment in storage on the grid is helping, California is still facing a tense couple of months ahead.

Some corporate news: Wood Mackenzie expands energy transition expertise with acquisition of Roskill

Wood Mackenzie has bought Roskill, a privately-owned company that is a leader in metals and materials supply chain intelligence. In particular, it provides market-leading analysis, data, and insight on battery raw materials, which are of course a critical factor in the energy transition.

In brief

Oil and gas executives in the southern US on average expect WTI crude to be $70 a barrel at the end of the year, according to the latest quarterly energy survey from Federal Reserve Bank of Dallas. The survey of executives in Texas, New Mexico and Louisiana indicated that the pick-up in activity in the industry was gathering pace, and that cost pressures were also rising. Among E&P executives, 51.5% said they had increased capital spending from the first quarter, compared to just 9.1% who had cut it. Among oil services companies, 56% of executives said they had seen input costs rise since the past quarter, and not one said they had seen costs fall. As usual, the survey is full of interesting quantitative and qualitative information, and is well worth a look.

Devon Energy is the latest US E&P company to set emissions reduction goals. It is aiming for net zero by 2050 for its Scope 1 and 2 emissions, created by its own operations and its purchased energy. Wood Mackenzie’s Ryan Duman commented that the targets were a bold move that meant Devon was leapfrogging most of its peers in its ambition.

A bipartisan group of US senators has come up with their plan for investing in the country’s infrastructure, with the aim of finding a package that can win sufficient votes from both parties to pass in Congress. The total amount they suggest spending is much smaller than President Biden had sought for his American Jobs Plan — $579 billion, compared to an estimate of $2.3 trillion for his proposal — but the senators have borrowed several of his key energy-related ideas. Their package includes money for roads and bridges, public transport, and airports, as well as $16 billion for cleaning up orphan wells and abandoned mines, and $73 billion for power infrastructure.

However, there is one big difference: the senators have cut almost all of the $174 billion that President Biden had proposed to spend to support the transition to electric vehicles. In fact, the senators’ package includes a new annual surcharge on EVs to help pay for the new spending. Given

President Biden’s views on the strategic importance of EVs for the future of US manufacturing, that section of the senators’ plan is likely to prove particularly contentious.

The World Bank has published its Climate Change Action Plan for 2021-25, saying it represents “a shift from efforts to ‘green’ projects, to greening entire economies”.

The World Bank Group says it will align its financing flows with the objectives of the Paris Agreement on climate change, and aims to raise to 35% the share of its financing that leads to cuts in greenhouse gas emissions or helps adaptation to the effects of climate change. The blocks on financing for coal power, thermal coal mining, pipelines and oil and gas production will continue. However, the bank has been criticised by environmental campaigners for leaving the door open to supporting some natural gas projects, “in countries where there are urgent energy demands and no short-term renewable alternatives to reliably serve such demand.”

Environmental campaigners are trying to persuade the UK government to reject the development of the Cambo field in the West Shetland Basin.

The Thacker Pass lithium mine project in Nevada has put local communities “at the frontlines of an energy transition from climate-warming fuels, coal mining and combustible engines to solar energy, lithium mining and electric vehicles”, the Nevada Independent reported.

NIMBYism can be a problem for any kind of development, even for solar power.

The CME Group is launching a futures contract for carbon emissions offset credits.

“Science and engineering graduates, who once would have been lured into structuring and building quantitative trading models [in finance], would rather go to SpaceX or work on battery technology and at electric vehicle startups like Rivian,” Anjani Trivedi reported for Bloomberg.

And finally: a summer reading suggestion. The Good Hand: A Memoir of Work, Brotherhood, and Transformation in an American Boomtown, by Michael Patrick F. Smith, is a memoir about working in the North Dakota oilfield at the tail end of the boom years in 2013-14. It has had some rave reviews, and the author has written a couple of essays for the New York Times and the Guardian that are worth reading. One I am looking forward to for when I get some time off next month.

Quote of the week

“The Chinese see our passivity as their opportunity… China has invested nationwide to manufacture 21st century products, from electric vehicle batteries and solar panels to semiconductors. Meanwhile, the United States has simply grown more reliant on other countries to supply the ingredients in our cars, our phones, our lives. We have ceded the skyrocketing clean energy market to our economic competitors – and created vulnerabilities in our own economy.” — Jennifer Granholm, the US energy secretary, wrote an op ed column for USA Today, arguing the case for the Biden administration’s proposal to invest hundreds of billions of dollars in low-carbon energy.

Chart of the week

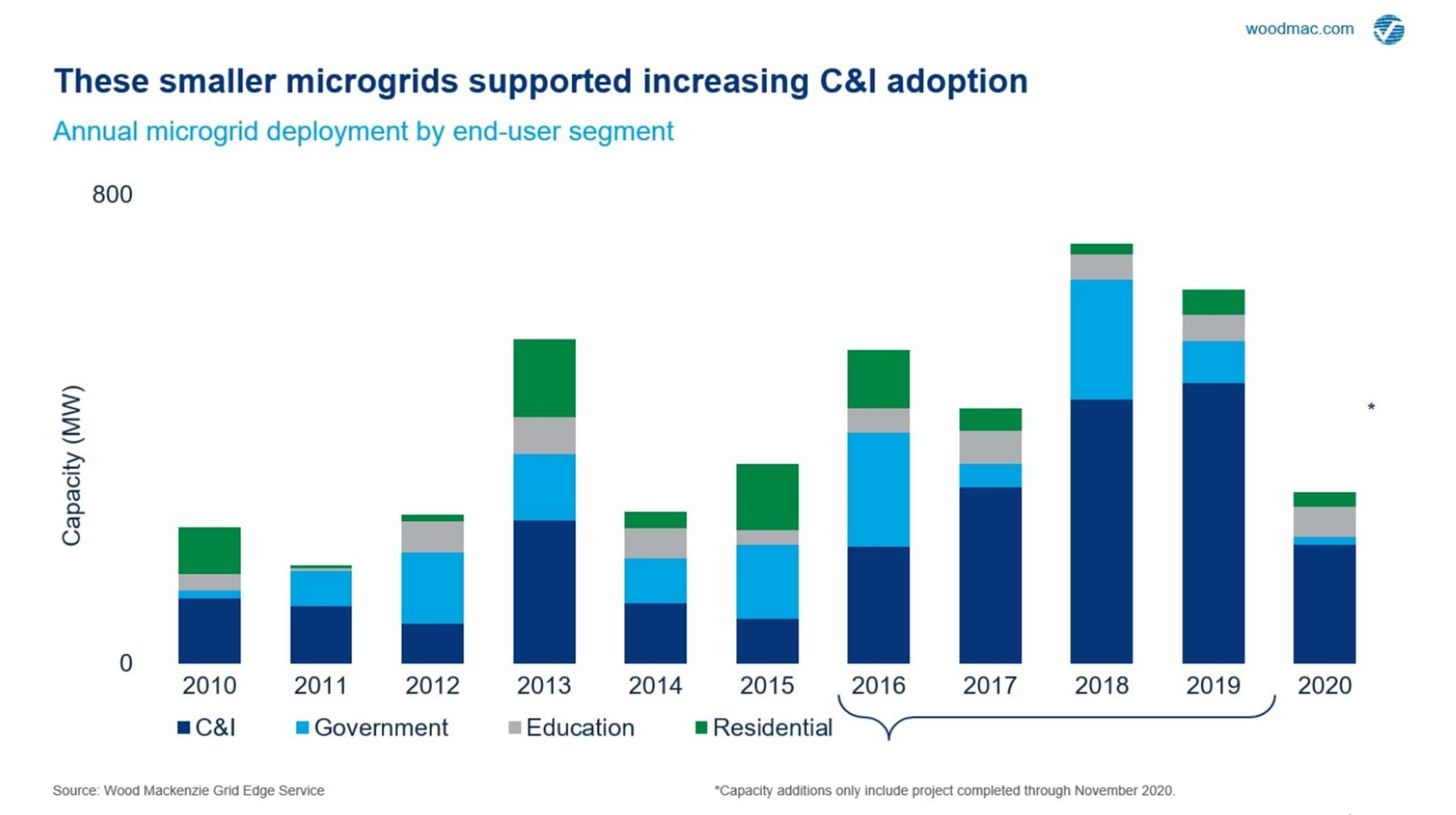

This comes from a presentation given by Wood Mackenzie’s Isaac Maze-Rothstein at the National Conference of the American Public Power Association. It shows the annual US capacity additions for microgrids: local electricity networks that can provide power during a blackout using disbtributed energy resources. You can see that installations have been on a rising trend, with commercial and industrial users leading the way.

The growth in recent years has been driven by smaller systems, with capacities of under 25 MW and particularly under 5 MW. Maze-Rothstein says businesses have become increasingly interested in this kind of microgrid because of growing concerns about the resilience of their power supplies, and the opportunities created by the rise of energy-as-a-service, which allows customers to buy energy without having to make investments up front.

Source: Wood Mackenzie