OPEC and its allies have shrugged off pressure from the US to cool down the market with more supply, affirming Oct. 4 their original plan to increase crude oil production in November by just 400,000 b/d.

Unmoved by a rally that has seen physical crude prices hitting three-year highs in recent days, OPEC+ delegates pointed to a still uncertain prognosis for the coronavirus pandemic and said they remain unconvinced that the market had structurally moved higher.

Internal forecasts reviewed by OPEC+ delegates showed global oil demand growth of only 700,000 b/d between September and December, with an oversupply looming by the end of the year, which seemed to support a conservative approach.

Continuing with the gradual 400,000 b/d monthly production increases under an agreement forged in July “will allow us to continue the normalization of the market,” Russian Deputy Prime Minister Alexander Novak said in his opening remarks to the OPEC+ ministerial meeting.The coalition next plans to meet Nov. 4 to review production plans for December.

Brent jumps

S&P Global Platts assessed Dated Brent at $81.77/b in the wake of the decision, an almost 4% surge from the previous close and more than double what the benchmark was a year ago.

Crude prices have been juiced by the spillover effect from a red hot natural gas market that has prompted some power plants to switch feedstock to oil liquids, as well as the global economy’s continued emergence from the pandemic.

US officials, concerned about rising domestic fuel costs, had complained that the OPEC+ alliance was holding back too much supply, with the Biden administration dispatching a delegation to Saudi Arabia in late September to discuss oil and other issues.

Saudi officials, for their part, have said they see a relatively healthy market. Amin Nasser, CEO of Saudi state energy giant Aramco, said at an industry conference as OPEC+ ministers met that gas-to-oil switching in the power sector could increase oil demand by as much as 500,000 b/d.

But the kingdom, which retains significant sway as OPEC’s largest member, has typically urged the group to tread a more cautious path, preferring the risks of overtightening the market to oversupplying it and crashing prices again.

“Given the looser oil balance in the early part of next year, it would not be logical to add extra barrels to the market now, only to take them off a few months later,” said Tamas Varga, an analyst with brokerage PVM Associates.

Capacity constraints

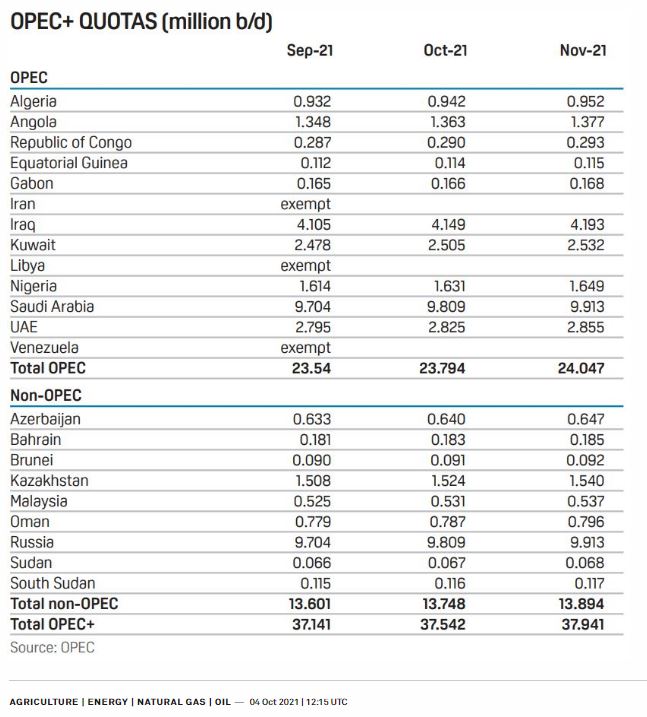

The decision will shrink what had been an unprecedented 9.7 million b/d in production cuts implemented in May 2020 during the worst of the pandemic to about 4.2 million b/d for November. If the OPEC+ alliance maintains its steady tapering, the cuts will be eliminated by around September, though ministers have said their monthly gatherings would give them flexibility to adjust volumes as needed.

In practical terms, however, the market may be even tighter, with several OPEC+ members lacking sufficient spare production capacity to meet their allocated increase, most notably Angola, Nigeria and Malaysia.

Reflecting the capacity constraints, collective OPEC+ compliance with quotas hit 119% in August, according to Novak. Iran and Venezuela, both exempt from quotas under the deal, are also heavily impaired by US sanctions targeting their oil sales.

“To be honest, the group is not bringing back 400,000 b/d a month,” one source involved in the meeting told S&P Global Platts. “Many producers can’t meet their targets.”

Platts Analytics estimates that as of September, OPEC+ members Saudi Arabia, the UAE, Russia, Kuwait and Iraq held 95% of the world’s 4.6 million b/d of spare production capacity.

Quick decision

Delegates said there was no serious push among the coalition to hike output by more than the plan, and arriving at the decision did not take long.

A nine-country advisory committee co-chaired by Saudi Arabia and Russia first met online and made a recommendation to affirm the prescribed increase in less than half an hour. The full 23-country OPEC+ alliance then convened its videoconference and rubber-stamped the proposal about an hour later.

With US producer rivals still hobbled by the pandemic and Hurricane Ida, OPEC+ ministers, who collectively control about half of global crude production, remain in firm control of oil prices. Come the November meeting, ministers will hope for greater insight into winter fuel demand and a clearer verdict on whether their plans to keep easing supply back to the market have kept the global economic recovery on track.

Source: Platts