[ad_1]

The product tanker market has a long way to go, as global gasoline demand is expected to lag in terms of demand recovery, with crude oil expected to recover first. In its latest weekly report, shipbroker Intermodal said that “while approaching the second half of the year and summer season is just around the corner, COVID vaccination programs are steadily moving forward with N. America and Europe leading the race. In this context, demand for oil products is expected to recover during the next quarters. While more people get vaccinated and travel restrictions are eased by governments, global oil products inventories are estimated to have dropped close to the 5 year average range for this time of year, with the Atlantic driving most of the destocking, thus refineries production will have to gradually increase looking forward”.

The product tanker market has a long way to go, as global gasoline demand is expected to lag in terms of demand recovery, with crude oil expected to recover first. In its latest weekly report, shipbroker Intermodal said that “while approaching the second half of the year and summer season is just around the corner, COVID vaccination programs are steadily moving forward with N. America and Europe leading the race. In this context, demand for oil products is expected to recover during the next quarters. While more people get vaccinated and travel restrictions are eased by governments, global oil products inventories are estimated to have dropped close to the 5 year average range for this time of year, with the Atlantic driving most of the destocking, thus refineries production will have to gradually increase looking forward”.

Source: Intermodal

Intermodal’s Tanker Broker, Mr. Dimitris Kourtesis said that “as per the latest IEA report, in 2020 we saw a record decline in oil demand by 8.5 MB/D, which is now expected to rebound by + 5.4 MB/D in 2021 and to fully recover to pre-pandemic levels by end of 2022 with an additional +3.1 MB/D. Global gasoline demand is most likely to lag other oil products in returning to pre-covid numbers, as the combination of teleworking and the increase of electric cars will play a major role in the next two years. However, last to see a full demand recovery will be jet fuel, as international aviation has a long way to go until most of the population is vaccinated and consumers’ preferences normalize to pre-COVID levels, likely to take place after 2022”.

Mr. Kourtesis added that “for the time being, with bunker prices hovering at low to mid USD 500 PMT for VLSFO and close to USD 600 PMT for MGO, TCEs for tankers have been suppressed further on top of weak fundamentals. Nevertheless, tanker Owners are hopeful that the market will start recovering, as the market trough we are experiencing will soon be exhausted. Charterers now working most of the cargoes privately to prevent owners from being bullish and from time to time we are seeing long tonnage lists that further weaken the market”.

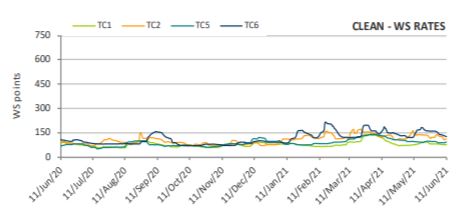

“VLCC rates are still moving close to zero tce’s or even at some cases “moving” at negative numbers, there was some additional movement on the WAF/EAST route but was not enough to push rates, same story with Aframaxes and Suezmaxes east of Suez, rates remained flat with Aframaxes around ws90 @ 80kmt (usd 1,750 p/d) and Suezmaxes at ws54-55 @ 130kmt. In the Mediterranean, Aframaxes tried to work their way and push rates slightly higher but was quite unfortunate, owners still working cross-med cargoes at low ws90 levels @ 80kmt (usd 2,665 p/d), Suezmaxes are being left spot as the scarce availability of cargoes limits the option of picking a cargo without a negative return”, Intermodal’s broker noted.

Source: Intermodal

Meanwhile, “CPP MR east of Suez they are pretty much bottomed out with a lot of Singapore ballasters joining the Fujairah list as they have aggressively been capped by LR1’s that had long tonnage lists trying to kill some time with short voyages, cross AG still stands at below USD 200k levels, (usd170k-180k) and AG/EAFR standing at WS154 @ 35KMT, (tce circa usd 6,500 pdpr) LR’1 & LR2’S freight market continues to soften this week, with TC1(AG/JAPAN) at WS75 and LR1’S dropping below WS90 to Japan. In Med, not much happening on the MRs as mentioned earlier many of the ships are being swept from the market on a private basis without showing the cargoes to the market, cross med cargoes are being fixed at sub ws125 levels and BSEA/MED at WS134-135. Continent still drives the market as the most active in West of Suez, TC stands [email protected] (abt 2300 usd/day) with the ARA/WAF at some cases loosing full of its premium points, despite owner’s preference to pick voyages with WAF options as the demurrage improves their returns”, Mr. Kourtesis concluded.

Nikos Roussanoglou, Hellenic Shipping News Worldwide

[ad_2]

This article has been posted as is from Source