The upshot to yesterday’s ECB is more purchases for longer, but dissent makes it difficult for EUR rates to price this outcome with great conviction. Still, upside to EUR yields is diminished and a further widening against GBP and USD rates is possible ahead of today’s PMIs, and next week’s FOMC.

The ECB delivered an even more dovish forward guidance

The ECB delivered on expectations of a more dovish forward guidance at its July meeting. A side by side comparison of the old and new forward guidance suggests a later date for the first hike, by up to 18 months. The new wording pledges not to tighten policy until the ECB sees inflation reaching 2% well ahead of the end of its projection horizon. In the press conference, president Christine Lagarde specified this meant the mid-point of its roughly three year forecast horizon. This compares with the previous wording referring to the end of the same projection horizon. So far so dovish.

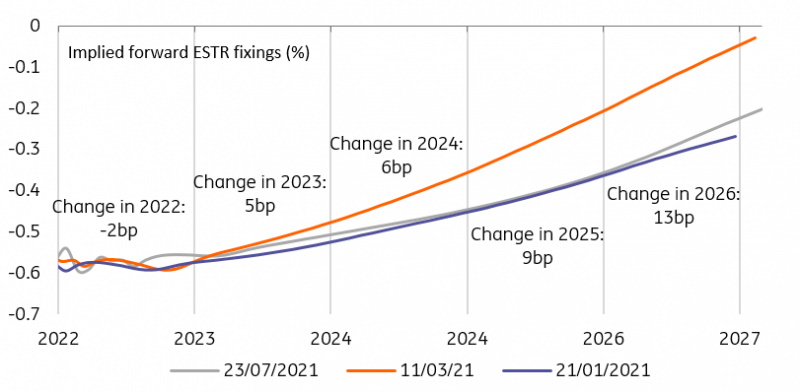

ESTR swaps have priced out the hikes they were expecting a few months ago

Source: Refinitiv, ING

Where we feel the ECB missed the mark is by not making more explicit reference to asset purchases, arguably its marginal tool of choice. In the new guidance as in the old, the end of purchases remain subordinated to the rates forward guidance. This clear hierarchy between its two main tools is perhaps what prevented markets from reacting more forcefully to the change of wording. Another factor might be that changes were well flagged although our own judgement is that expectations were low going into the meeting.

The upshot: supply/demand imbalance for even longer

This means it might take time for markets to come around to the view held by our economics’ team, that PEPP tapering is an ever more distant prospect, and that the asset purchase programme could even be boosted in size and extended in time. The rise in Covid-19 cases in much of Europe and associated restrictions might provide cover for this decision as the programme is closely tied to the ‘pandemic emergency ‘ in Europe.

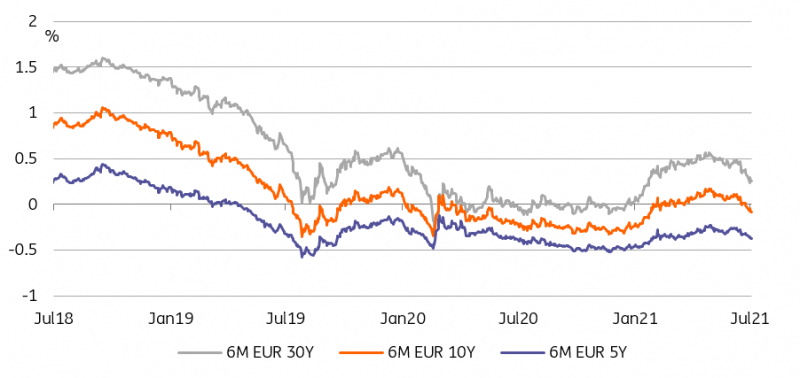

More ECB purchases for longer will make it even more difficult for rates to rise

Source: Refinitiv, ING

An alternative, or complementary, measure would be to boost the other asset purchase programme, the APP, but this would precipitate a debate on the legal limits to the programme that we are sure the ECB is keen to avoid. For now, however, rates markets need not worry about that. The upshot is that the squeeze on EUR bond markets is set to extend for the years ahead. This validates the rally seen in rates this summer and limits their ability to rise back in tandem with other markets when economic reality reasserts its grip on valuations.

A cloud on the horizon persists. ‘ECB sources’ stories published in the press after the meeting highlighted dissent from a handful of governing council members to the new forward guidance. Worse, linking the forward guidance to asset purchases as well as interest rates was proposed, and rejected. This will make it more difficult for markets to draw any conclusion from this meeting and price more aggressive QE, but we think they will, eventually.

Today’s events and market view

Today’s Eurozone PMIs are expected to show a modest slowdown in manufacturing activity but an acceleration in services. The focus will be once more on prices gauges but the ECB has taken some pressure off the market with its dovish turn, and by repeating its view that inflation will prove transitory.

Their UK equivalent should be stable at elevated levels but there, the debate raging about early tightening means there is less protection for GBP rates in case of a bumper reading. As a result, we see EUR rates as liable to further outperformance relative to USD and GBP peers today, especially since the focus will quickly turn to next week’s FOMC event risk and to US Treasury supply in the belly of the curve.

Source: ING