Global natural gas demand will snap back from low 2020 pandemic levels, driven largely by a global economic recovery and industrial growth in Asia-Pacific countries, and this trend could imperil climate goals, the International Energy Agency said in a report issued July 5.

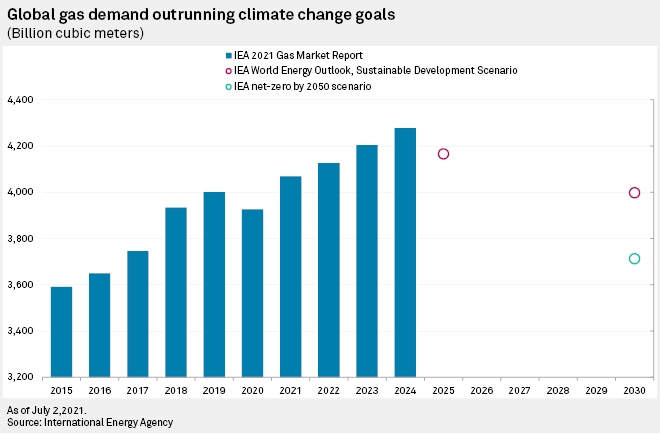

“Unless major policy changes to curb global gas consumption are introduced, demand is set to keep growing in the coming years, albeit at a slower pace, to reach nearly 4,300 [billion cubic meters] by 2024, a 7% rise from pre-Covid levels,” the IEA said in the report.

The Paris-based intergovernmental organization called for countries to take action to reduce carbon emissions toward net-zero in the next decades. “Strong and early policy actions and investment are required, with impacts on gas demand that would commence during our forecast period and intensify significantly over the course of the 2020s,” the IEA said.

LNG exports from the Middle East and the U.S., along with pipeline gas from Russia, could satisfy the call for more natural gas around the world, IEA Director for of Energy Markets and Security Keisuke Sadamori said in a presentation before the release of the global gas market report covering 2021 to 2024. A coming wave of U.S. LNG export terminals will supply the flexibility and pricing to keep the global gas market stable, Sadamori said.

“Further flexibility will help ensure the security of supply in an increasingly interdependent global gas market,” Sadamori said. “Destination-free U.S. LNG is contributing to this, as the U.S. projects account for the large majority of additional LNG supply capacities to be commissioned in the coming three years.” Gas for those terminals will come from U.S. shale basins.

But despite taking market share away from higher-carbon fuels such as coal, natural gas alone still contributes to carbon emissions in excess of IEA’s net-zero emissions scenarios, the organization said. The gas industry must start to increase the production of zero-carbon fuels, such as hydrogen, while cutting emissions of methane, a potent greenhouse gas, Sadamori said.

“The inflection is stronger if compared to the net-zero-by-2050 scenario, with our 2024 forecast standing close to 15% above the 2030 level,” Sadamori said. “The gas demand projection should, therefore, flatten to keep on track for the global net-zero emissions by 2050.”

Any attempt to make climate goals will require policymakers and governments to push the gas industry quickly toward lower emissions, particularly in the developed world where fuel switching to gas has mostly occurred, Sadamori said. “Natural gas demand will grow slower compared with previous periods, but that is still high when we compare that to the sustainable net-zero climate-friendly actions.”

The IEA said U.S. shale gas drillers are increasingly seeking to certify their production as responsibly sourced. “[EQT Corp.], the United States’ largest shale producer, announced in April a test program covering over 200 Pennsylvania well pads,” the agency said. “About 4 Bcf/d of production is to be certified, according to its environmental, social and governance performance.”

“This follows similar statements made earlier this year by shale producer Chesapeake Energy Corp., as well as LNG export project owners Cheniere Energy Inc. and Next Decade Inc,” the IEA said. LNG exporters in particular are under pressure from international buyers to quantify and reduce the amount of carbon emitted in the supply chain.

EQT went beyond its earlier announcements of “responsible natural gas” production when the company announced it would replace all the pneumatic controllers on its wells and pipelines and purchase carbon offsets to be net-zero in its Scope 1 and Scope 2 emissions by 2025. Scope 1 emissions are the direct carbon emissions of the company’s operations, while Scope 2 emissions are the indirect carbon emissions from a firm’s supply chain.

Source: Platts