China’s four oil giants lifted their average utilization rate to a 19-month high of 84% in August as plants returned from maintenance, in line with the expectation that the state-run refineries would compensate for the throughput cut by their independent peers.

While independent refineries were expected to cut utilization rate in the second half of 2021 due to tightened access to feedstocks, state-run refineries would raise throughput in order to compensate for the reduction.

In August, 41 refineries under Sinopec, PetroChina, CNOOC and Sinochem planned to process 32.79 million mt, or 7.76 million b/d, of crude, against their nameplate capacity of 9.24 million b/d, Platts data showed on Aug. 25.

Their utilization rate rose from 82% in July, when they planned to process 7.58 million b/d of crude, thanks to two refineries resuming production in August.

Sinopec’s 360,000 b/d Maoming Petrochemical ran at about 110% of its nameplate capacity in August, after restarting its 200,000 b/d CDU from maintenance on July 19.

Meanwhile, PetroChina’s 200,000 b/d Jilin Petrochemical also restarted from turnaround on July 19, raising the oil giant’s average runs from 73% in July to around 76% this month.

In the private refining sector, a cut in utilization rate of over five percentage points was seen in August, due to crude import quota shortages.

The 400,000 b/d Hengli Petrochemical (Dalian) plant lowered its run rates to around 100% in August from 105% last month, which is the lowest level since May 2020. Over the past 12 months, the refinery’s average utilization rate was at around 106%.

Meanwhile, Zhejiang Petroleum & Chemical, or ZPC, has kept its 200,000 b/d CDU in phase 2 project shut since late-July, despite it obtaining 3 million mt of crude import quota recently. Currently, ZPC is running its 400,000 b/d phase 1 project at 100% of capacity. Therefore, its monthly throughput is about 1.7 million mt, falling from about 2 million mt/month when it ran three CDUs at 80% over January-July.

In addition, the weekly run rate at the 43 Shandong-based independent refineries was at 62.3% as of Aug. 18, down from 65.7% as of July 21, according to energy information provider JLC.

Meanwhile, China’s Zhejiang Petroleum & Chemical is likely to obtain an additional 4.5 million mt of crude import quotas in September for its new 20 million mt/year phase 2 project, sources with knowledge about the matter said. This would bring the total quotas allocated to the refiner to 24.5 million mt for 2021, against a total 40 million mt/year of capacity that ZPC targets to run this year.

Sinopec’s Hainan Petrochemical refinery in southern China plans to export about 110,000 mt of refined oil products in August, 57% higher from 70,000 mt planned for July, according to a refinery source. The Hainan refinery plans to process 800,000 mt of crude oil in August, the source noted. This is equivalent to around 102% of its nameplate processing capacity, unchanged from July, according to Platts calculations.

Separately, Japan’s crude run rates rose to 77.1% during Aug. 15-21, up from 74.7% in the previous week, as refiners increased their crude throughput by 3.1% week on week to 2.67 million b/d, data from the Petroleum Association of Japan showed Aug. 25.

The increased crude run and throughput came as Japan’s refining capacity of 3.458 million b/d returned to operation on Aug. 14, following the restart of ENEOS’ fire-hit 136,000 b/d crude distillation unit at its Oita refinery.

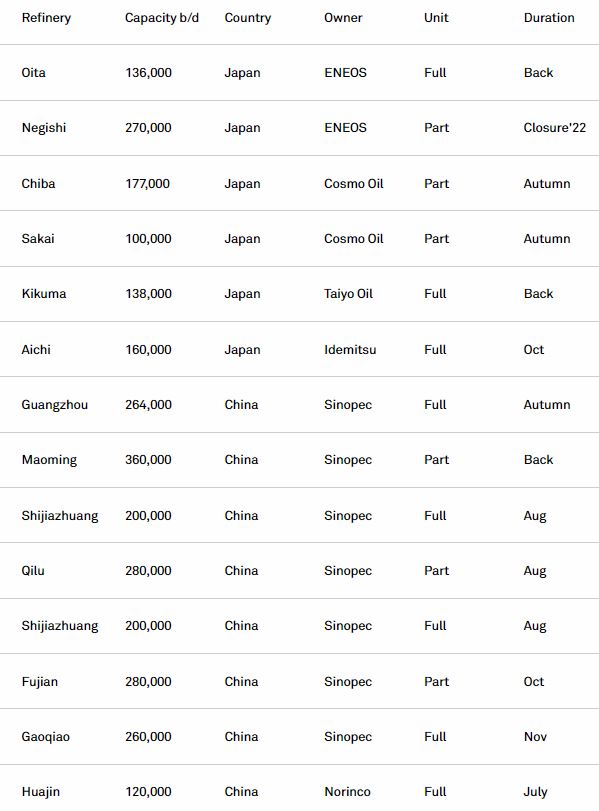

NEW AND ONGOING MAINTENANCE

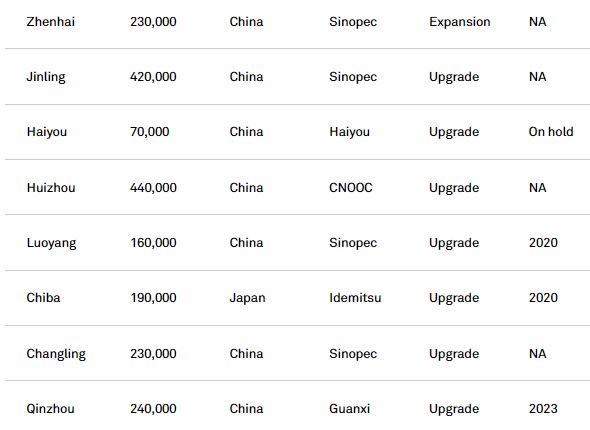

UPGRADES

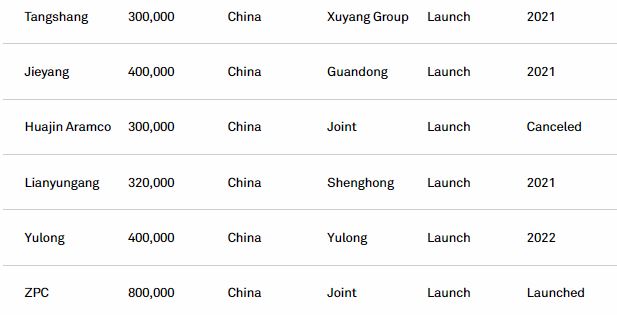

LAUNCHES

Near-term maintenance

New and revised entries

Japan

** Japanese refiner Cosmo Oil plans to shut the sole 100,000 b/d crude distillation unit at the Sakai refinery in western Japan on Aug. 20 for a scheduled turnaround, a company source said Aug. 18.

** Japanese refiner Taiyo Oil restarted the 32,000 b/d No. 2 crude distillation unit at its sole 138,000 b/d Kikuma refinery in western Japan on Aug. 8 after completing scheduled maintenance, a company official said Aug. 16.

** ENEOS restarted the fire-hit sole 136,000 b/d crude distillation unit at its Oita refinery in the southwest on Aug. 14 after completing restoration work, a spokeswoman said Aug. 16. A fire broke out at the Oita CDU on May 26 last year during scheduled maintenance that had started on May 12. The fire caused the crude distillation tower at the sole Oita CDU to bend.

China

** Sinopec’s Maoming Petrochemical ran at about 110% of its nameplate capacity in August, after restarting a CDU from maintenance on July 19. Maoming Petrochemical has restarted its 10 million mt/year CDU after maintenance over June 10-July 19.

** PetroChina’s Jilin Petrochemical restarted around July 20 from scheduled maintenance over June 1-July 19.

** Sinopec’s Qilu Petrochemical has shut its 4 million mt/year CDU for maintenance from Aug. 2, which will last till Sept. 21.

** Sinopec’s Gaoqiao Petrochemical will shut the entire refinery for maintenance from Oct. 10 till early-December.

** China’s Norinco Huajin in northeastern Liaoning province will postpone the startup of its refinery until the end of August from the original plan of around Aug. 15 due to the bearish market, a source with knowledge of the matter said. The refinery was shut for month-long maintenance on July 15. “Oil product prices have been low due to relatively bearish demand, while feedstock costs are high, leading to thin profits,” the source said.

Existing entries

China

** China’s Zhejiang Petroleum & Chemical shut the third 10 million mt/year (200,000 b/d) CDU at its 20 million mt/year Phase 2 project in late July, due mainly to shortage of crude oil import quotas, according to refinery sources. The third CDU, which started up in November 2020, brought its total operational refining capacity to 30 million mt/year (600,000 b/d).

** Sinopec’s Fujian Refining and Chemical Co. refinery in southeastern Fujian province will shut a 4 million mt/year CDU for maintenance from mid-October to mid-November.

** Sinopec’s Shijiazhuang Petrochemical will be shut for an overall maintenance over end-August till end-October.

** Sinopec’s Guangzhou Petrochemical will shut a 8 million mt/year CDU for maintenance between mid-October and the end of November.

Japan

** Japan’s Cosmo Oil plans to shut the 75,000 b/d No. 1 crude distillation unit at its 177,000 b/d Chiba refinery in Tokyo Bay as well as the sole 100,000 b/d CDU at the Sakai refinery in western Japan for scheduled maintenance in the autumn. The works are expected to last about a month at both units.

** Japan’s Idemitsu Kosan plans to shut the sole 160,000 b/d CDU at its Aichi refinery from October to November.

** Japan’s ENEOS said it will decommission the 120,000 b/d No. 1 CDU at its 270,000 b/d Negishi refinery in Tokyo Bay in October 2022. It will also decommission secondary units attached to the No. 1 CDU, including a vacuum distillation unit and fluid catalytic cracker. ENEOS will also decommission a 270,000 mt/year lubricant output unit at the Negishi refinery.

Upgrades

Existing entries

** PetroChina’s Guangxi Petrochemical in southern Guangxi province plans to start construction at its upgrading projects at the end of 2021, with the works set to take 36 months. The projects include upgrading the existing refining units as well as setting up new petrochemical facilities, which will turn the refinery into a refining and petrochemical complex. The project will focus on upgrading two existing units: the 2.2 million mt/year wax oil hydrocracker and the 2.4 million mt/year gasoil hydrogenation refining unit. For the petrochemicals part, around 11 main units will be constructed, which include a 1.2 million mt/year ethylene cracker, a 450,000 mt/year HDPE unit and a 500,000 mt/year FDPE unit, as well as other facilities.

** Sinopec’s flagship refinery Zhenhai Refining & Chemical will start construction work in October at its phase 2 expansion project, adding another 11 million mt/year of refining capacity as well as 1.5 million mt/year of ethylene plant. Once the project is completed, Zhenhai Petrochemical’s primary capacity will rise to 38 million mt/year, with 3.7 million mt/year of ethylene capacity. This follows the completion of the phase 1 expansion project, which was delivered on June 29 2021. Phase 1 project involved setting up a 4 million mt/year CDU and a 1.2 million mt/year ethylene unit, which started construction in April 2020. These new facilities will be integrated with the existing 23 million mt/year CDU as well as 1 million mt/year ethylene plant. In the longer term, the company has the ambition to grow itself into a refining capacity of 60 million mt/year and 7 million mt/year of ethylene by 2030.

** Sinopec’s Changling Petrochemical in central Hunan province plans to start construction for its newly approved 1 million mt/year reformer in 2021 and to bring its port upgrading project online by end-December.

** Japan’s Idemitsu Kosan plans to start work on raising the residue cracking capacity at its 45,000 b/d FCC at Chiba.

** China’s Sinopec Luoyang Petrochemical expects the start-up of the 2 million mt/year CDU expansion to be delayed to H1 2021.

** Axens said its Paramax technology has been selected by state-owned China National Offshore Oil Corp. for the petrochemical expansion at the plant. The project aims at increasing the high-purity aromatics production capacity to 3 million mt/year. The new aromatics complex will produce 1.5 million mt/year of paraxylene in a single train.

** Construction of a new 1 million mt/year coker at Chinese independent refinery Haiyou Petrochemical, in eastern Shandong, has been put on hold.

** Sinopec’s Jinling Petrochemical refinery in eastern China will build a new 600,000 mt/year vacuum distillation unit.

Launches

Existing entries

** China’s private Shenghong Petrochemical is preparing for official trial runs at Lianyungang on August 26 after the completion of construction of its core facilities on June 30. The core facilities include a 16 million mt/year CDU, sulfur recovery units, naphtha hydrocracker and its crude tanks.

** Chinese privately owned refining and petrochemical complex Zhejiang Petroleum & Chemical is scheduled to start up the second 10 million mt/year CDU at its 20 million mt/year Phase 2 project. It launched the first CDU of the second phase expansion project in November 2020. The refinery first came online in December 2019.

** Honeywell said China’s Shandong Yulong Petrochemical will use “advanced platforming and aromatics technologies” from Honeywell UOP at its integrated petrochemical complex. The complex will include a UOP naphtha Unionfining unit, CCR Platforming technology to convert naphtha into high-octane gasoline and aromatics, Isomar isomerization technology. When completed Yulong plans to produce 3 million mt/yr of mixed aromatics. Shandong’s independent greenfield refining complex, Yulong Petrochemical announced the start of construction work at Yulong Island in Yantai city at the end of October 2020. Construction work is expected to be completed in 24 months. The complex has been set up with the aim of consolidating the outdated capacities in Shandong province. A total of 10 independent refineries, with a total capacity of 27.5 million mt/year, will be mothballed over the next three years. Jinshi Petrochemical, Yuhuang Petrochemical and Zhonghai Fine Chemical, Yuhuang Petrochemical and Zhonghai Fine Chemical will be dismantled, while Jinshi Asphalt has already finished dismantling.

** Saudi Aramco has pulled out from a joint project to build a greenfield 300,000 b/d refining and petrochemical complex in northeast China. Aramco originally signed a deal with China’s North Industries Group (Norinco) and Panjin Sincen to form Huajin Aramco Petrochemical Co. in February 2019. The joint venture planned to build an integrated refining and petrochemical complex in northeast China’s Liaoning province Panjin city with a 1.5 million mt/year ethylene cracker and a 1.3 million mt/year PX unit.

** PetroChina officially started construction works at its greenfield 20 million mt/year Guangdong petrochemical refinery in the southern Guangdong province on Dec. 5, 2018.

** China’s coal chemical producer Xuyang Group has announced plans to build a greenfield 15 million mt/year refining and petrochemical complex in Tangshang in central Hebei province.

Source: Platts