Investment appetite for more dry bulk carriers has been rather high of late, thanks to a renewed rally in the dry bulk market. In its latest weekly report, shipbroker Allied Shipbroking said that “on the dry bulk side, it was a very interesting 2-week period, given the considerable flow of fresh transactions coming to light. The typical seasonal lull that takes place during the peak of the summer period did not discourage interested parties from remaining active, especially for medium to smaller size segments. Thinking about their respective freight returns, this came hardly as a surprise. At this point, it is yet to be seen whether the steep upward trajectory of Capesize earnings during the past couple of week or so could trigger further SnP volume (especially for this segment) in the near term. On the tanker side, the market moved on a completely different orbit, given the considerable number of vessels changing hands over the last two weeks or so. This can be seen as a mere reflection of an asymmetrical volume in en-bloc deals taking place, an indication (to some degree), that buying appetite exists (bargain deal hunting), even during the current uninspiring freight market regime”.

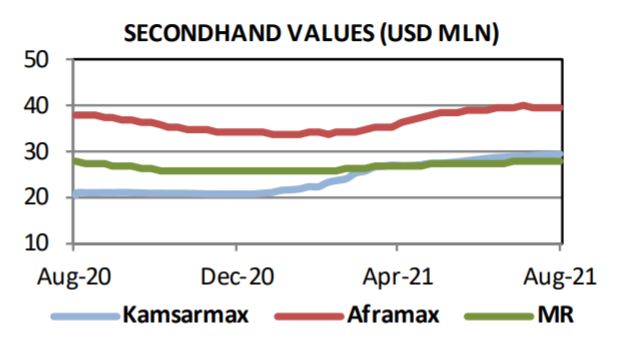

In a separate note, shipbroker Banchero Costa said that “during the week, two Panamaxes has been sold, Priscilla Venture abt 77k blt 2008 Oshima to Chinese buyer at $18.2 mln, while Ads Galtesund abt 76k blt 2007 Universal was reported at $15.8 mln basis delivery January 2022 difference in price can be also explained by delivery dates with Buyers paying higher prices today in order to obtain a more prompt delivery. After offers were invited earlier this month, three modern ultramaxes Asia Ruby II-III. IV abt 63k blt 2014 Jiling were reported sold at $67 mln en bloc to c.of Common Progress , last week Nord Hudson abt 61k blt 2014 Nacks was reported at $23.8 mln.

In the Handy segment, c.of Taylor Maritime was reported to be behind the sale of Glorious Saiki abt 37k blt 2012 Saiki at $17 mln, Pacific Bulker abt 36k blt 2015 Shikoku at $21 mln and Praslin abt 37k blt 2011 Hyundai Vinashin at $17 mln”. Meanwhile, in the wet market, Banchero Costa said that “in the tanker market, two St-St chemical tanker Bochem Antwerp abt 19k blt 2011 Kitanihon and FSL New York abt 19k blt 2006 Usuki were reported sold at $15.6 mln and $10 mln respectively. In the past week, Beech Galaxy and Lime Galaxy abt 19k blt 2007-08 Usuki were done at $23 mln en bloc. Also, Katsuragisan 300,000 dwt blt 2005 Kawasaki was sold at $29.5 mln region”, the shipbroker concluded.

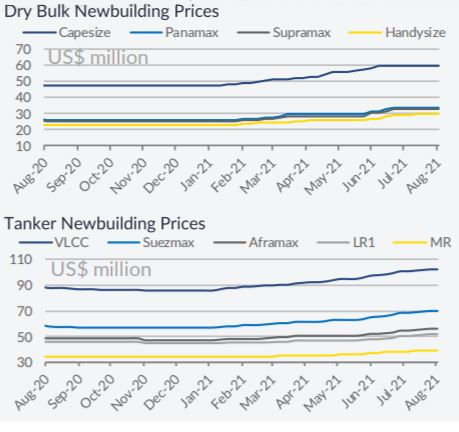

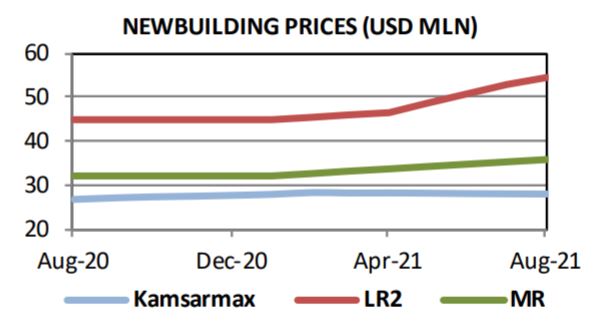

Meanwhile, in the newbuilding market, Allied said that “it seems that buying interest returned to the dry bulk newbuilding market in the midst of the summer holidays, as a fresh series of orders were noted in the sector. Most of the interest was focused on the Kamsarmax segment, with 6 new units being added to the orderbook. The persisting rising momentum of freight earnings and the overall positive demand-supply outlook in the segment have increased interest for newbuilding projects once again. However, the increasing trend of newbuilding prices is a potential obstacle in driving further investments and it is expected that this will continue being a bearish factor.

On the other hand, a silent two-week period was witnessed in the tanker newbuilding market. Overall sentiment has been devastated in the year so far, with the anticipated revival in earnings being constantly postponed. At the same time, newbuilding prices seem to not be reflecting at the moment these uninspiring fundamentals, as they have posted significant increases since the beginning of the year. Finally, the intense interest for newbuildings in the containership market resumed once again, with record earnings having boosted confidence amongst potential buyers”, Allied concluded.

Banchero Costa added that “while levels on the second hand market, particularly in the dry segment, are rising on a daily basis, there have been few Newbuilding orders placed this week. Eastern Pacific Spore placed an order at New Times for 3 x 210,000 dwt Iron Ore trader at a price of $67 mln per vessel. Vessels will be chartered out for 10 years to Rio Tinto for Australia/China trade are dual fuel. Deliveries will be made by the end of 2024. Zhejiang Xiehai Shipping China ordered 2 x 210,000 dwt Iron Ore trader at Qingdai Beihai for delivery end 2023 at $60 mln per unit. Vessels will be LUN ready”, the shipbroker concluded.

Nikos Roussanoglou, Hellenic Shipping News Worldwide