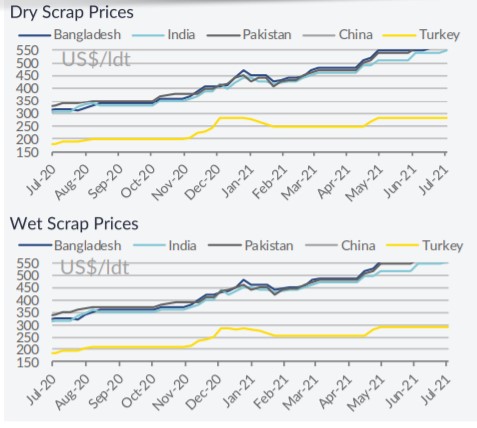

Ship owners are keeping their older ships in service, on the back of high dry bulk and container rates. As a result, tonnage availability in the demolition market is scarce and rates offered are through the roof, with some market observers reporting prices of up to $600/LDT.

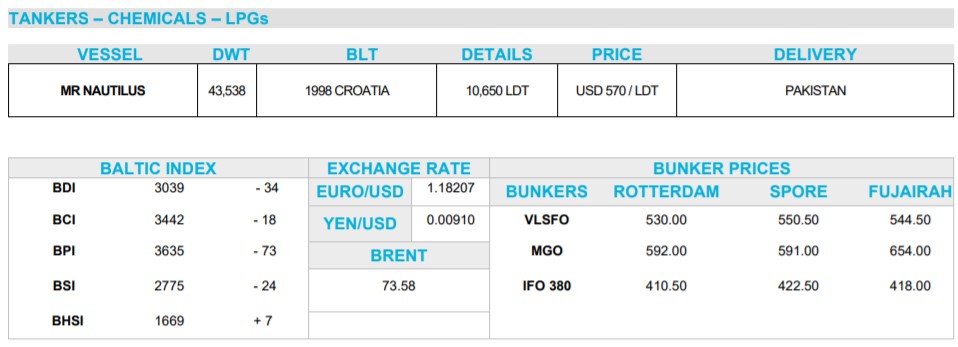

Source: Clarkson Platou Hellas

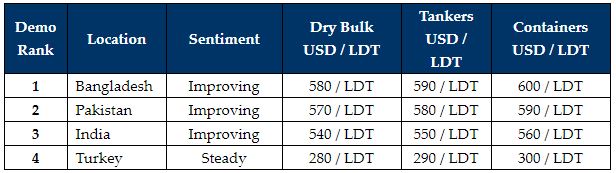

In its latest weekly report, shipbroker Clarkson Platou Hellas said that “the summer holiday period has certainly been felt this week as the market has felt the quietest it has been all year with the lack of workable tonnage alarmingly low, with few sales to report. This is a trend that now looks set to continue and could result in one of the most inactive summers for the market in quite some time, with there still being no clear sign of where the flow of tonnage is going to come from due to the continuing firm freight markets. With Eid holidays taking place next week in Pakistan and Bangladesh, operations from these locations next week may slow. We again emphasise that there should not be too much of a price depreciation and feel these impressive levels look set to stay in Pakistan and Bangladesh, with demand still high locally and the world economy continues to recover after the Pandemic. This has meant India continues to lag some way behind its neighbouring counterparts, with price levels still in the mid-low 500’s, although a rare unit for HKC recycling would be sure to catch their attention and cause an eager move. Much like the sub-continent, the rates from Turkey have made steady improvements over the last few weeks and non EU Recycling yards would be willing to indicate in the mid USD 300’s for prompt units. With the EU facilities being a case-by-case basis, due to the limited number of yards (and whether such a plot is open at a specific time), pricing is still the highest we have seen for EU recycling with levels hovering around the high USD200’s”, the shipbroker concluded.

Source: Allied Shipbrokers

In a separate note, shipbroker Allied added that “after a prolong period of high activity, things seem to have slowed down in the ship recycling market during this past week. A limited number of units were sent to scrapyards, while enquiries were also reduced, despite the resuming overall rising momentum of scrap prices. The lack of fresh interest was apparent in one of the most active demolition markets in the year so far, namely Bangladesh, during this past week. However, the attractive offered prices and the discouraging freight scene in the tanker sector seem to have retained optimism amongst local players for further businesses to take place in the coming weeks. In India, the domestic breakers may not be similarly positive, due to the limited activity conducted in the year so far, but fundamentals seem to be moving on an encouraging path. Local steel prices have increased, while the pandemic situation has started to improve, leaving some space for optimism. In Pakistan, the attractive scrap prices are also apparent, but activity is still limited here as well as of late. The new regulations over recycling tankers is likely to curb some interest from owners of vintage units, albeit domestic breakers expect demand to pick up again sooner or later” the shipbroker said.

Meanwhile, GMS (www.gmsinc.net), the world’s largest cash buyer said that “demo markets continue their upward trajectory this week and the USD 600/LDT barrier, as suspected last week, was indeed breached on a number of select units. This may be due to a general paucity in the overall supply of tonnage over these quieter summer / monsoon months, whilst local steel plate prices have regained momentum of late, especially after stalling a few weeks ago! Just how much longer this momentum will last remains to be seen. But for now, fundamentals for this seemingly sustained rally (of demand and pricing) from sub-continent End Buyers is clearly far from being satisfied at this time. Bangladesh leads the way once again with a stellar showing on levels this week, while Gadani Recyclers remains hot on the heels of their Chattogram competitors. Meanwhile, India remains positioned some ways behind its sub-continent recycling contemporaries, even though Alang Buyers are starting to narrow the gap (once again), especially after a downward trend that prevailed over the last few weeks. Lastly, the Turkish market remains suspended and relatively unchanged since last week, given the onset of Eid Holidays until July 26th, and an overall quieter time coming up for this market. Reopening days loom in the UK, with several states in the U.S. already starting to fully re-open, as the vaccine push ramps up so that economies can firm up again and some form of normality can finally ensue. However, the troubling Delta variant is starting to take hold and resuming the spread once again, especially amongst those who are yet to be vaccinated. Of course, there is still some resistance in certain countries where vaccine supplies and uptake have yet to fully take hold, but it will be interesting to see how those countries that are reopening, fare in the near future, as the world looks to put the worst of the pandemic behind”, GMS concluded.

Source GMS

Nikos Roussanoglou, Hellenic Shipping News Worldwide