China’s top low sulfur fuel oil producer Sinopec is likely to use up its export quotas for bonded bunkering in August, which would lead to tight supplies at the country’s bonded bunkering ports until new allocations are issued, market sources with knowledge about the matter told S&P Global Platts July 9.

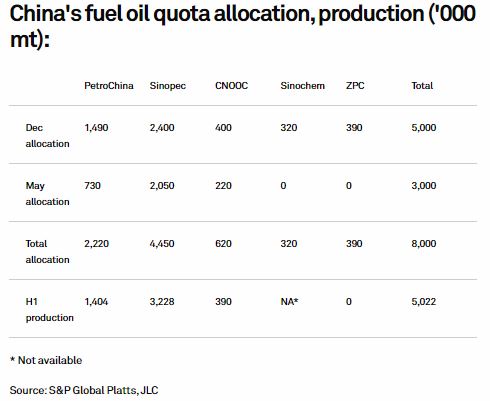

With an additional quota allocation in late May, Sinopec currently holds 4.45 million mt of quotas that allows the state-owned oil company to send its domestically produced tax-free LSFO to China’s ports for bonded bunkering.

Beijing in late May issued 2.05 million mt of such quotas to Sinopec, 730,000 mt to PetroChina and 220,000 mt to CNOOC, lifting the total quota allocation for bonded bunker fuel oil to 8 million mt for 2021, according to a Beijing-based source with knowledge about the matter.

“Sinopec is likely to use up its quota in around August, while the further round of allocation is unlikely to be released in this month [July], so [supplies will become] tight,” the source added.

Sinopec accounts for about 65% of China’s LSFO production, according to market sources.

In the first half of 2021, it produced about 3.23 million mt of the fuel, according to local information provider JLC.

Meanwhile, state-run PetroChina is expected to lift fuel oil output as it is running out of export quotas for gasoline, gasoil and jet fuel.

PetroChina produced about 1.4 million mt of bunker fuel oil in January-June, according to JLC, compared with the 2.22 million of quotas it holds for the barrel.

China’s domestically produced LSFO cargo exports will be subject to a Yuan 1,218/mt ($187.80/mt) consumption tax and a 13% value added tax, as the export quotas for tax rebate or exemption are only applicable for bonded bunkering at Chinese ports.

Supply constraints

Due to the expectation of tightening inventories, offers for delivered marine fuel 0.5%S bunker fuel at the bonded bunkering hub of Zhoushan remained resilient despite the recent sluggishness in FOB Singapore marine fuel cargo valuations.

As Sinopec is likely to have fulfilled its bonded bunker export quota, easing of the oversupplied market at Zhoushan would shore up valuations of delivered marine fuel 0.5%S fuel and spur a diversion of demand to Singapore, industry sources said.

“Coupled with healthier demand for spot delivered marine fuel 0.5%S at Zhoushan since the beginning of this week, the tightening inventories of very low sulfur fuel oil also help support premiums of the delivered grade over the Asian fuel oil benchmark,” a Zhoushan-based bunker supplier said.

Amid an overall $34.37/mt decline in FOB Singapore marine fuel cargo assessments since July 7, cash differential between the Zhoushan-delivered marine fuel 0.5%S and the FOB Singapore cargo for the same grade climbed to an almost six-week high of $12.17/mt on July 8, Platts data showed.

Platts data on July 8 also showed that the Zhoushan-delivered marine fuel 0.5%S was assessed at a $7.25/mt premium to the delivered grade in Singapore, the highest since May 27 when this differential spiked to $13.25/mt.

Source: Platts