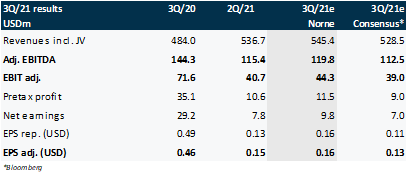

Stolt-Nielsen posts its 3Q (June-August) figures next week. There were little news in the chemical tanker space and only minor movement in the shipping rates during the quarter, therefore we anticipate similar numbers to be reported and reiterate Buy recommendation with small alterations to the LT prognosis as well.

Lower margins, but no more dragging negative impact expected

2Q21 figures were still said to have been impacted by the dragging harsh winter, therefore for 3Q21 we anticipate somewhat higher revenues QoQ. Still, the increased bunker prices should lower the margins, thus the anticipation of the remaining figures in the income statement are to be very similar to the previous quarter. Terminals and Tank containers are expected to continue the strong performance and offset any fluctuation in the tanker space.

Still waiting for improvement in rates

The longer-term outlook is cautiously optimistic as the world is still recovering from the Covid-19 and there are lots of uncertainties on new variations of the virus and the political decisions towards them. In the meantime, Stolt-Nielsen is strengthening other segments: expanding the capacity of the terminals in the U.S. and Korea, widening the Tank Container segment and expanding Sea Farm offering. The latest news were that Stolt Sea Farm has completed its first harvest of sole at its RAS farm in Tocha, Portugal at the beginning of September.

Buy remains on limited changes to estimates

Only limited changes to estimates were made after a rather eventless quarter and we reiterate Buy recommendation for the stock. As we somewhat lowered the margins, the new Target Price is a tad lower at NOK 150/sh (NOK 155/sh previously) but still offers a solid upside.

Source: Norne Research