[ad_1]

An improvement in third quarter crude loadings from Iraq, could offer some scope for optimism among tanker owners. In its latest weekly report, shipbroker Banchero Costa said that “2020 was overall a very negative year for crude oil trade. Total loadings in the 12 months of 2020 were down -6.2% y-o-y to 2032 million tonnes, according to vessels tracking data from Refinitiv. 2021 so far is faring even worse. In the first 8 months of 2021, global seaborne crude oil trade declined by -6.5% y-o-y to 1294 mln tonnes. What’s worst is that so far there is no sign of things turning a corner. Even in August 2021, global crude loading were at 164.2 mln tonnes, which was essentially flat (+0.4% y-o-y) on the already depressed levels of August 2020, and down -8.1% compared to (pre-Covid) August 2019.

An improvement in third quarter crude loadings from Iraq, could offer some scope for optimism among tanker owners. In its latest weekly report, shipbroker Banchero Costa said that “2020 was overall a very negative year for crude oil trade. Total loadings in the 12 months of 2020 were down -6.2% y-o-y to 2032 million tonnes, according to vessels tracking data from Refinitiv. 2021 so far is faring even worse. In the first 8 months of 2021, global seaborne crude oil trade declined by -6.5% y-o-y to 1294 mln tonnes. What’s worst is that so far there is no sign of things turning a corner. Even in August 2021, global crude loading were at 164.2 mln tonnes, which was essentially flat (+0.4% y-o-y) on the already depressed levels of August 2020, and down -8.1% compared to (pre-Covid) August 2019.

According to Banchero Costa, “Iraq is the second largest seaborne exporter of crude oil in the Arabian Gulf after Saudi Arabia, and the third in the world behind Saudi Arabia and Russia. In 2020, Iraqi ports accounted for 7.7% of global crude oil loadings. This only covers cargoes loading in Basrah (pretty much the only loading port in Iraq), and does not even include the exports which go by pipeline via Turkey, i.e. Kirkuk grade oil from Northern Iraq. About 70 percent of volumes loaded in Basrah are carried in VLCCs, and about 25 percent is loaded in Suezmaxes. In the 12 months of 2019, Iraqi seaborne crude oil exports were as high as 176.3 mln tonnes.

Source: banchero costa &c s.p.a.

In 2020, however, limited global demand due to the pandemic affected shipments. In the 12 months of 2020, Iraq managed to ship just 151.7 mln tonnes of crude oil, down -14.0% year-onyear. For comparison, Saudi Arabia’s exports declined by -3.2% y-o-y in 2020, those from Russia declined by -13.1% last year, from West Africa they were down by -9.2% y-o-y. The only major exporter which performed well last year were the Unites States, with exports increasing by +7.1% y-o-y”.

The shipbroker added that “things didn’t really improved that much so far in 2021. In the first 8 months of 2021, seaborne crude oil exports from Iraq were down -4.4% y-o-y from the same period of 2020, at 99.6 mln tonnes, which compares to 104.2 mln tonnes in the same period of 2020, and 118.3 mln tonnes in the same period of 2019. In the first half of 2021 volumes were essentially flat at the same modest levels already seen throughout much of last year. However, there does seem to be an improvement in the third quarter, which we much hope can be sustained. In the first quarter of 2021 Iraq exported 35.9 mln tonnes, which represents a decline of -13.0% y-o-y from the 41.3 mln tonnes of 1Q 2020, but is essentially flat on the 36.5 mln tonnes of 4Q 2020 and the 34.6 mln tonnes of 3Q 2020. The second quarter of 2021 saw 36.5 mln tonnes shipped from Iraq, down -7.2% y-o-y from 2Q 2020, and down -18.3% from the second quarter of 2019, which just keeps the trend”.

Source: banchero costa &c s.p.a.

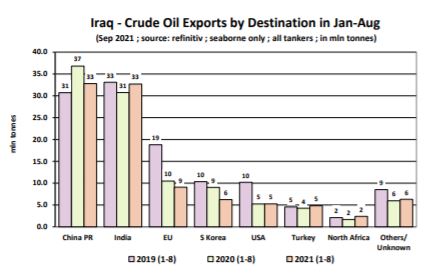

“However, August 2021 saw a jump to 14.4 mln tonnes exported in a month, which was the highest monthly figure since April 2020. The August 2021 figure was +12.9% up m-o-m from July, and +27.1% y-o-y from the dismal 11.3 mln tonnes in the same month of last year. In terms of destinations for the shipments, it’s a head to head between Mainland China and India, with 33% each. In the first 8 months of 2021, Iraq shipped 32.8 mln tonnes to Mainland China, which represents a -10.9% y-o-y decline from 36.8 mln tonnes in JanAug 2020, but more than the 30.7 mln tonnes in Jan-Aug 2019. Iraq also shipped 32.7 mln tonnes to India, which is actually an increase of +6.3% y-o-y from 30.8 mln tonnes in the same period of 2020, but still -1.2% less than the 33.1 mln tonnes in Jan-Aug 2019. The third top destination is the European Union, with 9.1 mln tonnes, or 9% of Iraq’s total exports. Shipments from Iraq to the EU declined by -13.3% y-o-y in Jan-Aug 2021 from 10.5 mln tonnes in Jan-Aug 2020, and are a massive -51.7% down from the 18.8 mln tonnes in Jan-Aug 2019”, Banchero Costa concluded.

Nikos Roussanoglou, Hellenic Shipping News Worldwide

[ad_2]

This article has been posted as is from Source