[ad_1]

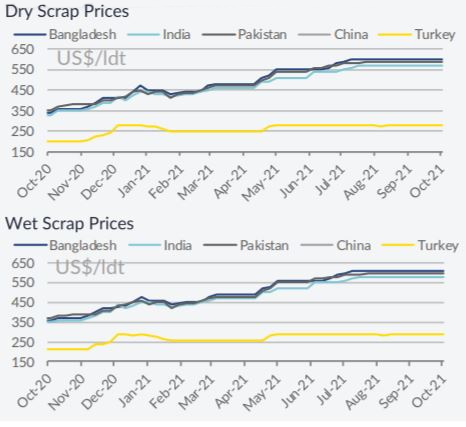

Wet tonnage has continued to dominate the demolition markets, which are expected to heat up in the weeks to come, at least in terms of prices offered, thanks to a rapidly rising price for steel. In its latest weekly report, shipbroker Clarkson Platou Hellas said that “strike whilst the iron is hot! A well-known phrase which has rung true this week as all markets in the Indian subcontinent have this week turned around their recent negativity and reports suggest that price levels are moving upwards once again. With the scarcity of tonnage set to continue, certainly the levels are destined to fluctuate around the USD 600/ldt level for some time. In relation to market supply, it remains very much bare, with few workable units being circulated. As the winter months draw closer, tanker Owners look set to hold on to tonnage with the expectation of firming rates and therefore this lack of supply seems set to continue throughout the Q4. The offshore sector is expecting a boom in next few months as more offshore drilling is predicted with daily increases in prices being witnessed, thus further supply from this area of the industry looks dormant to add to the short supply of dry bulk/container units”.

Wet tonnage has continued to dominate the demolition markets, which are expected to heat up in the weeks to come, at least in terms of prices offered, thanks to a rapidly rising price for steel. In its latest weekly report, shipbroker Clarkson Platou Hellas said that “strike whilst the iron is hot! A well-known phrase which has rung true this week as all markets in the Indian subcontinent have this week turned around their recent negativity and reports suggest that price levels are moving upwards once again. With the scarcity of tonnage set to continue, certainly the levels are destined to fluctuate around the USD 600/ldt level for some time. In relation to market supply, it remains very much bare, with few workable units being circulated. As the winter months draw closer, tanker Owners look set to hold on to tonnage with the expectation of firming rates and therefore this lack of supply seems set to continue throughout the Q4. The offshore sector is expecting a boom in next few months as more offshore drilling is predicted with daily increases in prices being witnessed, thus further supply from this area of the industry looks dormant to add to the short supply of dry bulk/container units”.

Source: Clarkson Platou (Hellas) ltd

In a separate note, Allied Shipbroking added this week that it was “a rather mediocre week for the ship recycling market, given the relative limited flow of units being sent to the breakers’ yards. In the Indian Sub-Continent, Bangladesh continues to hold top spot on the leader board, having already secured a plethora of larger LDT units (mostly tankers and FSU), especially as of these past few weeks. Moreover, despite the fact we haven’t seen any sales as of late, offered scrap price levels remaining firm, rather inline with the upward push in local steel plate prices. In India, local steel prices recovered quickly and to a fair degree, after the slump in the market of one week prior.

Source: Allied Shipbroking

At the same time though, local forex levels still seem rather uninspiring. Notwithstanding this, local breakers remain “hungry” for any available tonnage, especially as we progress further into 4Q21. Finally, Pakistan seems to be holding its ground steady, eager to compete at high levels, despite its currency depreciation and disadvantaging position (compared to Bangladesh) in terms of delivery costs for the larger LDT units”, Allied said.

Meanwhile, GMS , the world’s leading cash buyer of ships said this week that “the last quarter jump in local steel plate pries (and at varying degrees) seems to have swept across all major recycling markets (including China) this week. The jump in levels varied from as little as USD 5/Ton from the Chinese market, all the way to USD 30/Ton on the Turkish end, with the sub-continent markets bridging the gap. Despite the dry sector continuing to perform surprisingly well and keeping the markets starved of bulker and container units, as holidays descend upon India and China, it is time to take stock of what has been another busy quarter of mostly tanker scrapping, as this particular sector looks to get back on its feet next year, following a heavy year of recycling.

Source: GMS,Inc.

Local port positions across all sub-continent markets confirm this, given the number of wet units being delivered to Recyclers on a weekly basis. Overall, it is expected to be another frantic finale to the year, as prices remain firm at historical levels at or above USD 600/LDT and tanker charter rates (for the most part) remain in the doldrums, providing an alternate lifeline to the ship recycling sector. We have seen very few bulkers and containers for a majority of this year – with even older 90s built units passing surveys to continue trading, such has been the strength of current freight rates. Whilst steel remains firm and the currency in India Pakistan and (especially) Turkey) have been facing their shares of wobbles over the last couple of weeks, we do not anticipate ship recycling prices to decline significantly any time soon”, GMS concluded in its report.

Nikos Roussanoglou, Hellenic Shipping News Worldwide

[ad_2]

This article has been posted as is from Source