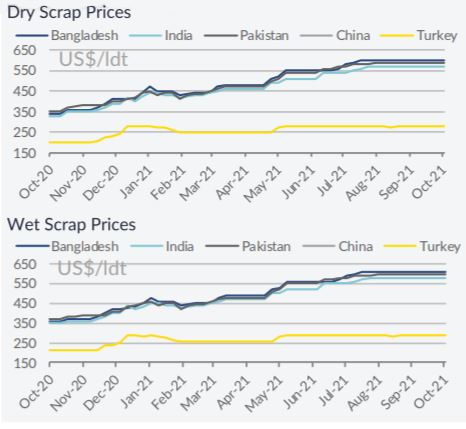

Wet tonnage has been feeding towards the demolition market over the past few weeks. In its latest weekly report, shipbroker Allied Shipbroking commented that “the tanker units were once again in the spotlight of the ship recycling market, with owners trying to restructure their fleet in an attempt to avoid further losses in a sector that has not seen any significant improvement in freight rates in the year so far. At the same time though, the rest of the key segments (dry bulk, containers, gas) continue witnessing favorable freight market conditions and thus there is a limited interest for retiring any tonnage, despite the current attractive scrap prices. Bangladesh and Pakistan remain the key destinations for owners at the moment, with stable fundamentals, firm steel prices and robust interest from scrapyards maintaining activity high for these countries. However, the persisting depreciation of the Pakistani rupee is likely to trim some of the interest for demolition business in the country. In India, things are less active, but HKC recycling continues to be a key advantage for the domestic market. Offered prices in the country can now compete the rest of Indian Sub-Continent, albeit the upcoming Diwali celebrations are likely to trim some interest over the coming days. All in all, tanker units are expected to continue to be the main source for demolition candidates entering the market, while the current firm scrap prices seem to be sustainable for the time being”, Allied said.

Meanwhile, GMS , the world’s leading cash buyer of ships said in its latest weekly note that “after a couple of weeks of mixed performances in steel plate prices from the sub-continent markets where the industry witnessed Indian levels suddenly jump towards the end of last week, whilst both Pakistani and Bangladeshi markets saw their plate prices decline, this week, the respective pendulums appear to be swinging back.

Bangladeshi plate prices finally steadied their recent month long decline through September, Pakistani plate made a small recovery and Indian levels plummeted nearly USD 25/Ton this week. In the West, Turkey spent another quiet, yet steady week, even though Lira concerns are now starting to permeate through the local recycling mindset. Supply too remains minimal and is possibly adding to the buoyancy of current vessel pricing in its own way.

Source: GMS,Inc.

Accordingly, we continue to see either Cash Buyers concluding previously purchased tonnage, or news of private sales surface as this week, news of a tanker and bulker (for strictly HKC SoC green recycling) were concluded this week. Local port positions also remain relatively full, with Chattogram (expectedly) claiming the highest volume of incoming tonnage in the subcontinent, for a few weeks now. Meanwhile, GMS is pleased and proud to present an excellent Thought Leadership article published by Ms. Prachi Shah (In-house Legal, GMS Dubai) covering tanker contracts. We invite you to read it at https://www.hellenicshippingnews.com/tanking-contracts-doctrine-of-good-faith-versus-wog-and-other-exclusionary-terms/.

In a separate note this week, Clarkson Platou Hellas said that “a quiet week has concluded with little activity being witnessed in the recycling sector.

All reports from the analysts suggests that the dry and wet sectors in the shipping community look set to continue its current firm stance and therefore, the current lack of tonnage for recycling being experienced will continue towards the end of the year. With this in mind, and on the back of positive steel markets, the expectation is that price levels will move one way, ie northwards, given the diminishing stockpiles from the actual yards and few new candidates replacing them. In addition, demand to buy tonnage should remain in place as the infrastructure led post-Covid recovery in most countries will drive the requirement of construction material. This therefore should ensure that price levels remain positive for certainly the foreseeable future and into 2022”, the shipbroker concluded.

Nikos Roussanoglou, Hellenic Shipping News Worldwide