Teekay Tankers Ltd. (Teekay Tankers or the Company) (NYSE: TNK) today reported the Company’s results for the quarter ended June 30, 2021:

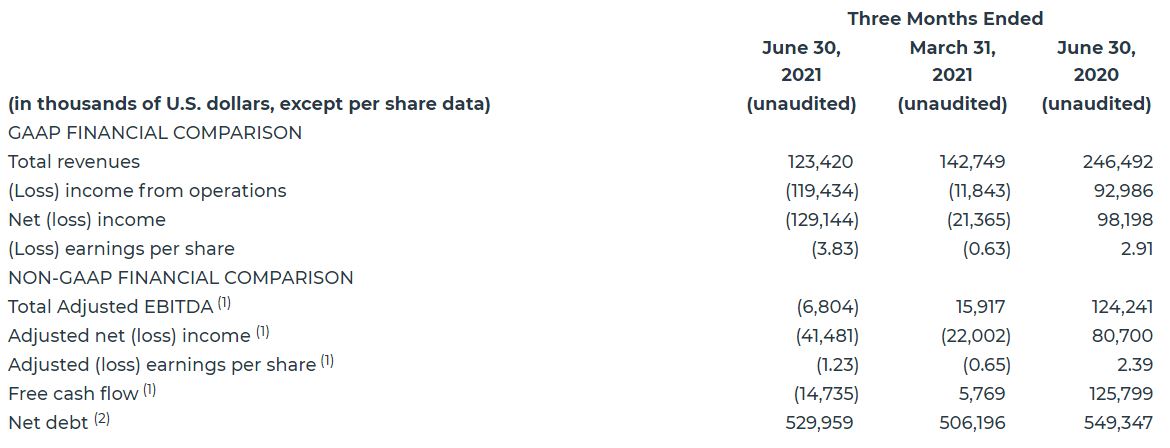

Consolidated Financial Summary

(1) These are non-GAAP financial measures. Please refer to “Definitions and Non-GAAP Financial Measures” and the Appendices to this release for definitions of these terms and reconciliations of these non-GAAP financial measures as used in this release to the most directly comparable financial measures under United States generally accepted accounting principles (GAAP).

(2) Net debt is a non-GAAP financial measure and represents short-term, current and long-term debt and current and long-term obligations related to finance leases less cash and cash equivalents and restricted cash.

(3) Pro forma for the $43 million refinancing of two unencumbered vessels that were previously under sale-leaseback arrangements. These two vessels were acquired for $57 million in May 2021 with existing liquidity and are expected to be refinanced as part of a new, lower-cost sale-leaseback financing in the third quarter of 2021.

(4) Net debt to capitalization is a non-GAAP financial measure and represents net debt, as described in note (2) above, divided by the sum of net debt and equity. This measure is used by certain investors and management to evaluate the Company’s use of financial leverage.

Second Quarter of 2021 Compared to First Quarter of 2021

GAAP net loss and non-GAAP adjusted net loss for the second quarter of 2021 were higher compared to the first quarter of 2021, primarily due to the expiration of certain fixed-rate time charter contracts, a higher number of scheduled drydockings, and lower average spot tanker rates during the second quarter of 2021. GAAP net loss in the second quarter of 2021 included a $86.7 million write-down of vessels, while GAAP net loss in the first quarter of 2021 included a $0.7 million write-down of an asset.

Second Quarter of 2021 Compared to Second Quarter of 2020

GAAP net loss and non-GAAP adjusted net loss for the second quarter of 2021, compared to the second quarter of 2020, were impacted primarily by lower average spot tanker rates in the second quarter of 2021, the expiration of certain fixed-rate time charter contracts, a higher number of scheduled drydockings, and the sale of two tankers during the first quarter of 2021. GAAP net loss in the second quarter of 2021 included a $86.7 million write-down of vessels, while GAAP net income in the second quarter of 2020 was positively impacted by a $15.2 million reversal in freight tax accruals relating to prior periods and a $3.1 million gain on sale of assets.

CEO Commentary

“Crude spot tanker rate weakness persisted in the second quarter of 2021 due to ongoing OPEC+ production cuts resulting from reduced oil demand related to the COVID-19 pandemic, an uneven economic recovery across various geographies, and a concentration of newbuilding deliveries in the first half of 2021,” commented Kevin Mackay, Teekay Tankers’ President and CEO.

“The tanker market weakened further early in the third quarter of 2021, particularly affecting our Suezmax tanker segment due to the timing of repositioning unfixed vessels. While the repositionings should optimize earnings for the full quarter, we have incurred additional bunker fuel expenses in the short-term, resulting in a lower reported third quarter to-date TCE rate,” commented Mr. Mackay. “Looking ahead, although the near-term outlook is uncertain due to COVID-19, we believe many of the leading indicators for a tanker market recovery continue to improve, including planned increases in OPEC+ production, declining global oil inventories, which are already below five-year average levels, and positive tanker fleet supply fundamentals as reflected in a low orderbook, heightened scrapping and a very limited amount of new tanker orders. Based on our forward view, we counter-cyclically in-chartered three Aframax-sized vessels for 18 to 24 months with extension options, which has been a profitable lever for us during past tanker market cycles.”

“The Company has a strong financial position with pro forma liquidity of approximately $274 million(1) and net debt to capitalization of 36 percent at the end of the second quarter of 2021,” commented Mr. Mackay. “As previously announced, we declared purchase options for a total of eight vessels on higher-cost sale-leaseback financings for a total of $185 million, two of which closed in May 2021. We have now signed term sheets for new lower-cost sale-leaseback financings for these eight vessels, totaling $142 million, which are expected to close in the third quarter of 2021 and result in interest expense savings for the first 12 months of approximately $11 million(2).”

(1) Pro forma for the $43 million refinancing of two unencumbered vessels that were previously under sale-leaseback arrangements. These two vessels were acquired for $57 million in May 2021 with existing liquidity and are expected to be refinanced as part of a new, lower-cost sale-leaseback financing in the third quarter of 2021.

(2) Assuming LIBOR rate of 0.20% in 2021 and 0.25% in 2022.

Summary of Recent Events

In November 2020 and March 2021, Teekay Tankers declared options to repurchase eight vessels that were under higher-cost long-term sale-leaseback financings. Two vessels were repurchased in May 2021 for $57 million, with the remaining six vessels expected to be repurchased for $129 million in September 2021. The Company has signed term sheets and is currently in documentation for new lower-cost sale-leaseback financings for total proceeds of $142 million to refinance these eight vessels, which financings are expected to be completed in the third quarter of 2021.

The Company has in-chartered two Aframax tankers and one LR2 tanker for periods of 18 to 24 months at an average rate of $17,800 per day. Each of the charters provides the Company with the option to extend for an additional 12 months at an average rate of $19,800 per day. Two vessels are expected to be delivered in August 2021 and the third vessel is expected to be delivered in late-2021 or early-2022.

Tanker Market

Crude tanker spot rates remained very weak during the second quarter of 2021 as the global COVID-19 pandemic continued to weigh on the crude tanker market. Some of the main factors which negatively impacted spot tanker rates included:

• Uneven oil demand recovery – According to the International Energy Agency (IEA), global oil demand increased by 1.1 million barrels per day (mb/d) during the second quarter of 2021. However, total oil demand of 94.6 mb/d was still significantly below pre-COVID-19 levels of approximately 100 mb/d. Furthermore, the recovery in oil demand has been very uneven across different geographies, with a much stronger rebound in North America and Europe and a slower recovery in Asia, Latin America, and Africa. The slower pace of recovery in Asia is particularly problematic for the tanker market, as it is a large driver of tanker tonne-mile demand. Crude oil imports into China were down 3 percent year-over-year through the first half of 2021, the first such decline since 2013.

• Continued OPEC+ supply discipline – Global oil supply continues to be constrained by OPEC+ production cuts, with global oil production of 94.5 mb/d in the second quarter of 2021 versus approximately 100 mb/d prior to the pandemic. The OPEC+ group did start to increase supply from May 2021 onwards, in line with their earlier pledge to raise production by 2.1 mb/d between May and August 2021. However, this did not translate fully into an increase in crude oil exports due to higher domestic oil consumption for power generation, particularly in Saudi Arabia.

• Decline in long-haul crude oil movements – A widening spread between the price of Brent and Dubai crude oil meant that Atlantic basin crude oil became less attractive to Asian buyers. This led to a decrease in long-haul movement from the Atlantic-to-Pacific during the second quarter of 2021, with Asian buyers targeting Middle-Eastern crude instead. This led to a drop in average voyage distances which was negative for crude tanker tonne-mile demand.

• Front-heavy newbuild delivery schedule – The global newbuilding delivery schedule for 2021 is heavily weighted to the first half of the year, which has led to a relatively large number of new tanker deliveries in the past six months. In the Suezmax sector, 20 of the 22 newbuildings set to deliver in 2021 have already been delivered. This has led to an increase in available fleet supply and, therefore, lower fleet utilization.

• Higher bunker prices – An increase in crude oil prices has led to higher bunker costs, which weighed on tanker spot earnings during the second quarter of 2021.

Looking ahead, the Company is encouraged by tanker supply and demand indicators, which the Company believes point towards a market recovery in the coming quarters. According to the IEA, global oil demand is expected to increase from 94.7 mb/d in the second quarter of 2021 to 99.4 mb/d by the fourth quarter of 2021, taking oil demand close to pre-COVID-19 levels by the end of 2021. This steep increase in demand should spur an oil supply response from both OPEC and non-OPEC producers, particularly with global oil inventories now below five-year average levels. The OPEC+ group has recognized that more oil is needed and has pledged to increase production by 2 mb/d between August and December 2021 at an even rate of 0.4 mb/d per month. Global oil demand is projected to grow by a further 3.1 mb/d next year and OPEC+ has announced that it will gradually phase out its remaining supply cuts by September 2022 in order to meet this additional demand. The return of OPEC+ production, coupled with a projected increase in non-OPEC supply of 2.2 mb/d in the second half of 2021 and a further 1.8 mb/d in 2022, should lead to a significant increase in crude tanker demand in the coming quarters, which is expected to help drive an increase in fleet utilization and, therefore, crude spot tanker rates.

Fleet supply fundamentals continue to look very positive. The tanker orderbook remains relatively low at approximately 8 percent of the existing fleet size, which is largely unchanged from last quarter. Tanker newbuild ordering slowed considerably during the second quarter of 2021, mainly due to a rapid increase in newbuilding prices. Rising newbuild prices were the result of higher steel costs and a record amount of containership ordering that has soaked up shipyard capacity through 2023 and into 2024. With newbuilding prices continuing to rise, the Company expects that the level of newbuild ordering will remain relatively low in the near-term. Higher steel prices have also led to an increase in tanker scrap values, which are currently at a 10-year high. This has led to an increase in tanker scrapping, with 6.6 million deadweight tons (mdwt) removed in 2021 year-to-date versus 3.5 mdwt and 3.4 mdwt in all of 2020 and 2019, respectively, and on an annualized basis, is also running ahead of the 20-year historical average of 9 mdwt per year. The combination of a relatively small tanker orderbook, low levels of new tanker orders, and increased scrapping are expected to keep tanker fleet growth at relatively low levels over the next two to three years.

In summary, the tanker market continues to be severely impacted by the effects of COVID-19 on tanker demand. However, the projected increase in both oil demand and supply, coupled with positive fleet supply fundamentals, point towards an improvement in crude spot tanker rates over the coming quarters.

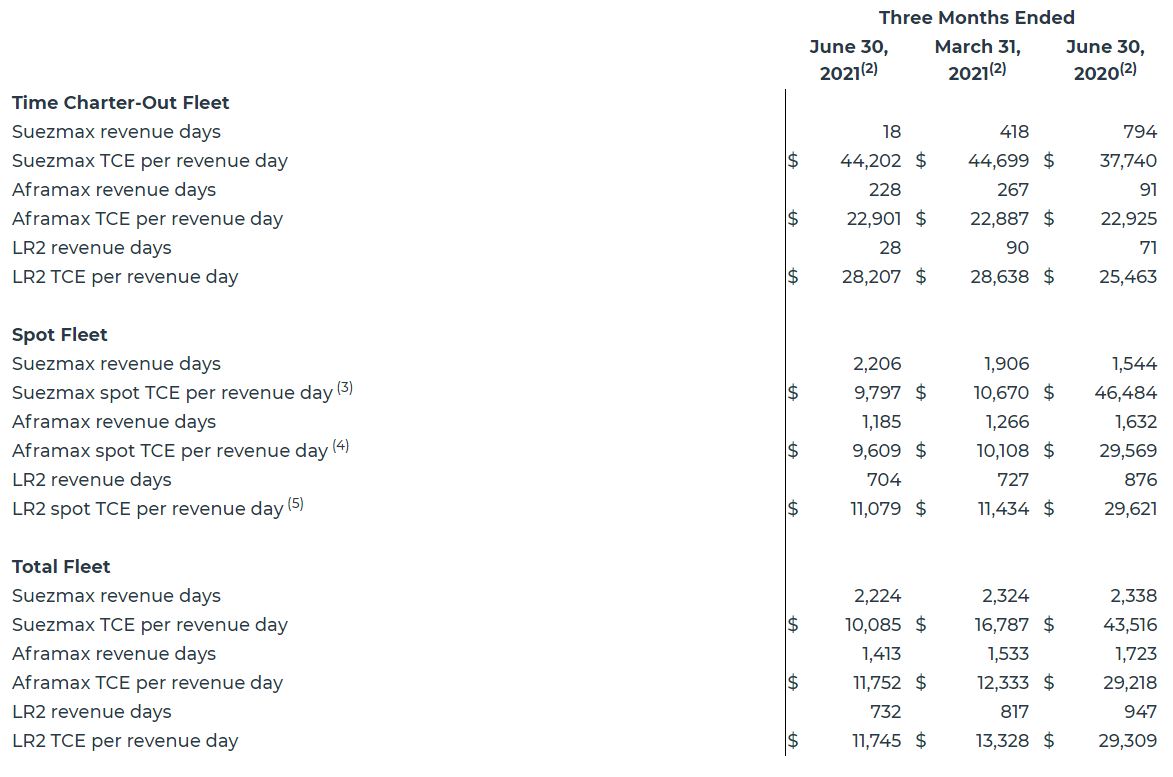

Operating Results

The following table highlights the operating performance of the Company’s time-charter vessels and spot vessels trading in revenue sharing arrangements (RSAs), voyage charters and full service lightering, in each case measured in net revenues(1) per revenue day, or time-charter equivalent (TCE) rates, before off-hire bunker expenses:

(1) Net revenues is a non-GAAP financial measure. Please refer to “Definitions and Non-GAAP Financial Measures” for a definition of this term.

(2) Revenue days are the total number of calendar days the Company’s vessels were in its possession during a period, less the total number of off-hire days during the period associated with major repairs, dry dockings or special or intermediate surveys. Consequently, revenue days represent the total number of days available for the vessel to earn revenue. Idle days, which are days when the vessel is available to earn revenue but is not employed, are included in revenue days.

(3) Includes vessels trading in the Teekay Suezmax RSA and non-RSA voyage charters.

(4) Includes Aframax vessels trading in the Teekay Aframax RSA, non-RSA voyage charters and full service lightering voyages.

(5) Includes LR2 vessels trading in the Teekay Aframax RSA, non-RSA voyage charters, and full service lightering voyages.

Third Quarter of 2021 Spot Tanker Performance Update

The following table summarizes Teekay Tankers’ TCE rates fixed to-date in the third quarter of 2021 for its spot-traded fleet only:

The Company’s lower spot-traded Suezmax TCE rate fixed to-date in the third quarter of 2021 is partially due to the timing of repositioning voyages for certain unfixed vessels, which have incurred bunker fuel expenses in the near-term without offsetting charter revenue which will be recorded later in the quarter when the vessels are fixed. Current Suezmax roundtrip TCE rates are averaging approximately $5,600 per day as per the latest Clarksons spot rates being reported.

(1) Rates and percentage booked to-date include Aframax RSA, full service lightering (FSL) and non-RSA voyage charters for all Aframax vessels.

(2) Rates and percentage booked to-date include Aframax RSA, FSL and non-RSA voyage charters for all LR2 vessels, whether trading in the clean or dirty spot market.

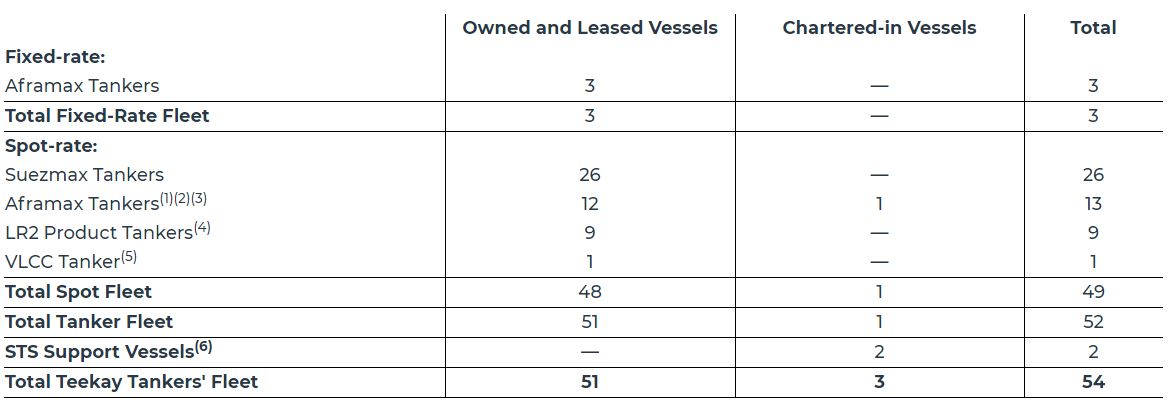

Teekay Tankers’ Fleet

The following table summarizes the Company’s fleet as of August 1, 2021:

(1) Includes one Aframax tanker with a charter-in contract that is scheduled to expire in August 2021. In July 2021, the Company entered into a new two-year charter-in contract for this tanker which will commence upon expiry of the previous contract and includes an option for the Company to extend for one year.

(2) Excludes one Aframax tanker which is expected to be delivered to the Company between the fourth quarter of 2021 and the first quarter of 2022 under a 24-month time charter-in contract with an option to extend for one year.

(3) Excludes one newbuilding Aframax tanker which is expected to be delivered to the Company in late-2022 under a seven-year time charter-in contract with options to extend for up to three years.

(4) Excludes one LR2 product tanker which is expected to be delivered to the Company in August 2021 under an 18 to 24-month time charter-in contract with an option to extend for one year.

(5) The Company’s ownership interest in this vessel is 50 percent.

(6) Excludes one ship-to-ship (STS) support vessel which is expected to be delivered to the Company in September 2021 under a 24-month time charter-in contract with an option to extend for one year.

Liquidity Update

As at June 30, 2021, the Company had total liquidity of $231.4 million (comprised of $60.5 million in cash and cash equivalents and $170.9 million in undrawn capacity from its credit facilities) compared to total liquidity of $371.7 million as at March 31, 2021. Pro forma for the pending refinancing of two unencumbered vessels that were re-acquired in May 2021, and which were previously under a sale-leaseback financing, the Company’s total liquidity would have been $274 million as of June 30, 2021.

Source: Teekay Tankers