The Institutional Investors Group on Climate Change (IIGCC) recently published a Net Zero Standard for oil and gas companies (the Standard), jointly developed by investors, advocacy groups and oil and gas companies. In short, it says companies need to do far more to align with the Paris Agreement, and it could have major implications for the sector.

We have taken an in-depth look at the Standard and identified seven crucial takeaways for oil and gas companies. You can buy the full report in our store, or read on for a brief outline.

Not just a European standard

The IIGCC is the European membership body for investor collaboration on climate change. Occidental was the only non-European oil and gas company involved in developing the framework. A group of leading oil and gas companies will now pilot the Standard: BP, Eni, Repsol, Shell, TotalEnergies and Occidental. But the aim is ultimately for a wider roll out across the sector.

While the Standard was developed by a working group with US$10 trillion of assets under management (AUM), the IIGCC itself has 340 investor members with more than US$42 trillion AUM. The group has not developed the Standard in a vacuum: the IIGCC intends it to feed into global investor initiatives such as the Net Zero Asset Managers Initiative and the CA100+, which have significant clout.

The Standard sets out a pathway that is aligned with net zero targets

The Standard provides a framework to make it easier for investors, analysts and other stakeholders to assess progress. Its 10-point action plan would improve the transparency of corporate transition strategies, reduce companies’ ability to obfuscate and improve the industry’s credibility with investors and other stakeholders.

We have identified seven key takeaways, which we outline here and analyse in the full report.

1. The Standard’s net zero ambitions go beyond nearly all corporate targets

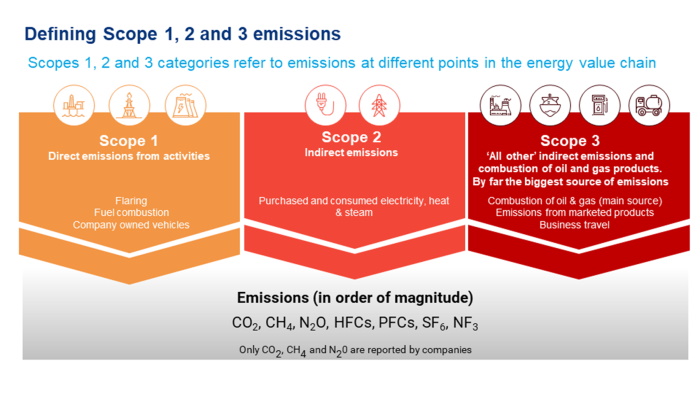

Participating companies must commit to net zero for all material emissions, including on a Scope 3 basis (use of sold products). We analyse the important strategic implications for oil and gas companies in the full insight.

2. Offsetting emissions will come under scrutiny

The Standard outlines how investors may deem less credible any strategies that rely heavily on carbon offsetting. In line with IPCC guidance and the CA100+ benchmark, the Standard stresses that companies should focus on reducing gross emissions. But the framework still provides considerable leeway to grow a large offsetting business.

3. The emphasis on strategic divergence is positive

The Standard acknowledges that “the most cost-effective strategy to reach net zero will vary by company”. It identifies a range of business models as viable strategies to net zero. Read the full report for a closer look at the main business models.

4. A detailed net zero financial framework will help build credibility

Under the Standard, companies should confirm that their investment strategy is aligned with net zero and set out key assumptions, including oil, gas and carbon prices. Operators should also disclose capital allocation plans for at least the next three years, breaking out upstream, exploration, carbon capture, utilisation and storage (CCUS) and green investment.

5. The drive for greater disclosure and standardisation is promising

The Standard makes clear prescriptions as to what companies should disclose and how they should report. These range from high-level net zero ambitions to operational level detail. It is a positive step in terms of getting the basics right.

6. Investors will be a powerful force for more widespread adoption

CA100+ has considerable weight. Signatories include global heavyweights such as Blackrock, Fidelity and CalPERS. The backing of CA100+ or a meaningful sub-group could drive broader industry adoption. The IIGCC also hopes that debt holders will hold non-public companies to account using the same standard.

7. Companies need to start acting now to mitigate carbon risk

The report highlights that emission reductions across the board mean significant fossil fuel demand destruction – and financial risk to investors. Shareholders will, therefore, assign greater transition risk to longer-dated emissions reduction strategies.

Source: Wood Mackenzie