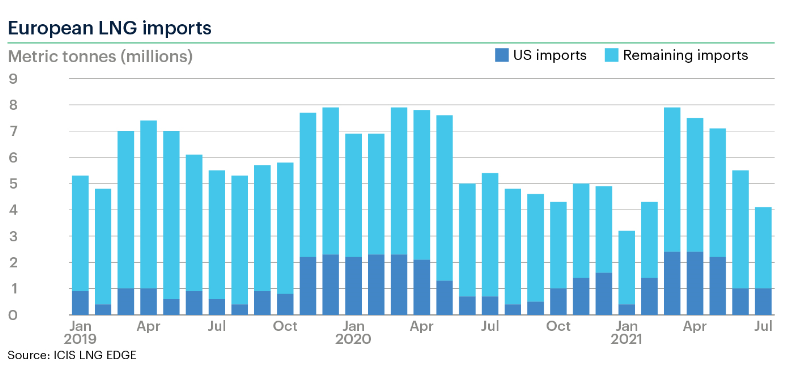

European imports of US LNG remained at 1m tonnes for the second month in a row in July, with overall inflows into the region shrinking amid high Asian demand and surging Brazilian consumption.

This is despite European gas hubs testing new highs amid prolonged supply concerns.

But the region will find it difficult to remain competitive in the near term with potentially greater profit margins for US producers on offer in Asia.

IMPORTS CURBED

July’s European imports of US LNG totalled 1m tonnes, unchanged from June, and only 0.3m tonnes higher that 2020 levels when the height of the coronavirus pandemic was distorting trade flows and demand patterns.

Overall European LNG imports totalled 4.1m tonnes in July, a month-on-month fall of 25% and the lowest July levels since 2018.

As well as Asia’s relative competitiveness in the global market, Europe’s inability to draw in greater LNG supplies has been hampered by rising Brazilian demand.

Brazil was the second largest importer of US LNG, behind South Korea, for the second month in a row with 900,000 tonnes, 17% of the total.

This translated into the country’s largest percentage share of US LNG since October 2017 at almost 21%.

Depleted hydroelectricity stocks amid historic drought conditions have seen the country increase its demand for thermal power generation leading to higher LNG imports.

Last month, ICIS LNG Analytics indicated that Brazil’s LNG demand would be 6.8m tonnes this year , nearly triple 2020 imports, amid the prolonged squeeze in margins.

HIGH ASIAN DEMAND

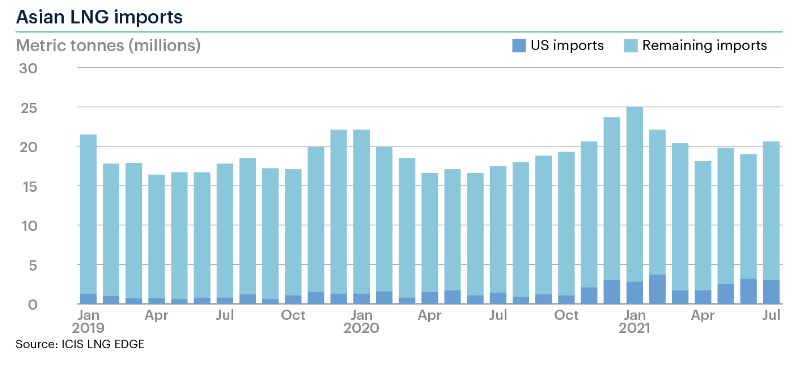

US LNG supply into Asia – represented by the top five buyers of China, Japan, South Korea, India and Taiwan – totalled 3m tonnes in July. This was a monthly decline of 200,000 tonnes but was the highest ever figure for July, more than double 2020 volumes which was the previous high.

South Korea dominated Asian inflows with 1.1m tonnes followed by Japan with 700,000 tonnes.

Outright LNG imports were 21m tonnes, a five-month high.

US MARGINS

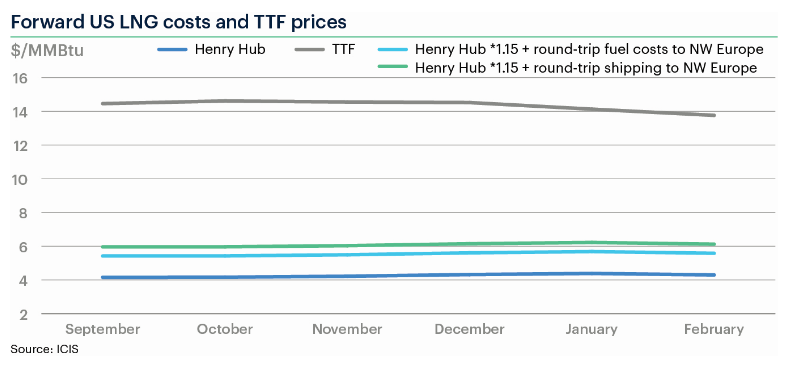

On 4 August, the ICIS East Asia Index for September ’21 held a $8.47/MMBtu premium over the estimated US cargo cost, when full-cost shipping from the US Gulf to Japan is included.

In contrast, the ICIS TTF September ’21 price recorded an $8.53/MMBtu premium over the US Henry Hub equivalent, plus the 15% premium applied in some LNG offtake contracts, in addition to round-trip shipping costs.

Expectations of low LNG supply, robust injection demand and rising carbon and coal markets lent support to European gas hubs midweek.

But spot Asian LNG prices maintained their uptrend on 5 August with the ICIS front month assessed at $15.85/MMBtu, the highest value since 15 January.

Further gains are likely to keep Europe at a competitive disadvantage in the near term, leaving the possibility of prolonged supply tightness and a bull run in global gas spreads going into the winter period .

Source: ICIS by Christopher Rene , https://www.icis.com/explore/resources/news/2021/08/05/10671129/us-lng-into-europe-checked-by-tight-global-fundamentals