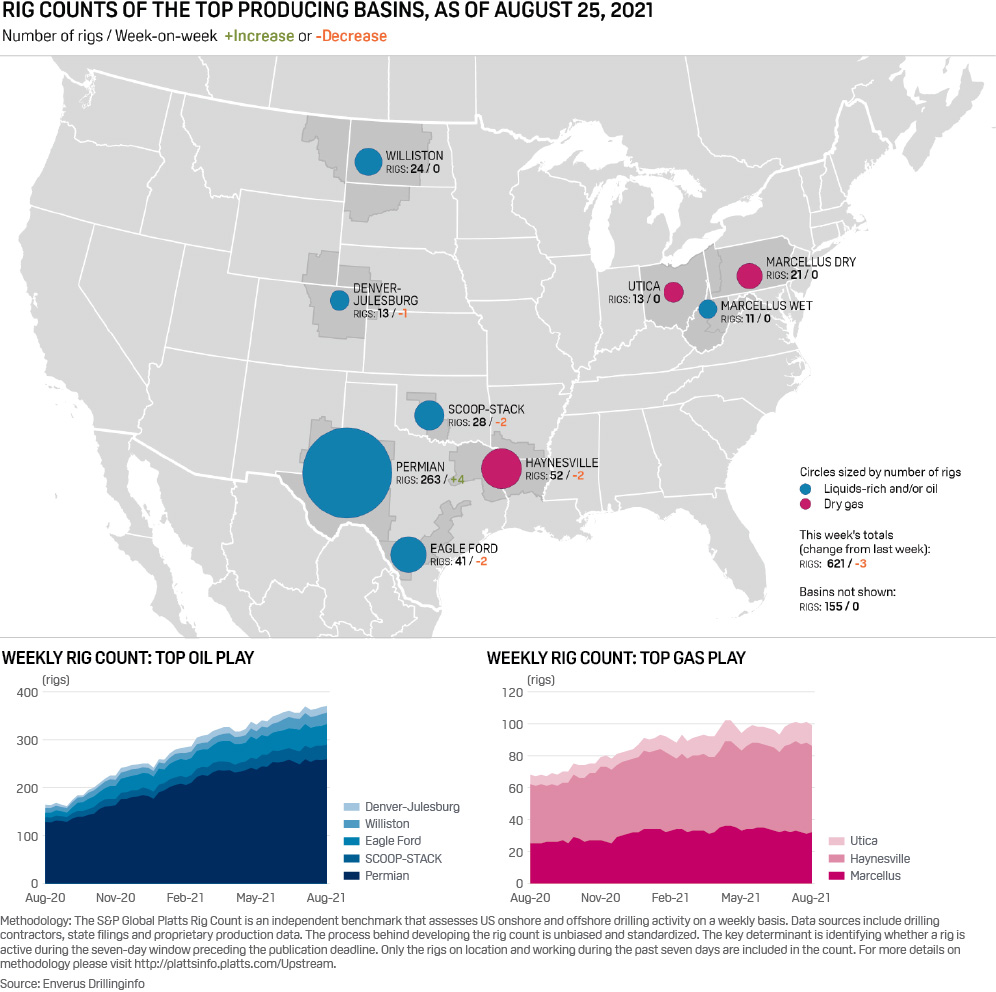

The US oil and gas rig count fell three to 621 on the week, energy analytics and software company Enverus said Aug. 26, with the Permian up four as the only major basin to post a weekly gain.

The Permian’s count reached 263 for the week ended Aug. 25, the highest level since 262 in the week ended April 22, 2020.

The rig count in the Permian, the largest producing region in the US with 4.65 million b/d of oil and 12.5 Bcf/d of natural gas, had been stuck the 250s range since early June 2021.

Rig counts in other basins either stayed the same or lost rigs week on week.

Shedding two rigs apiece were the Haynesville Shale of East Texas/Northwest Louisiana (52 rigs), the Eagle Ford Shale of South Texas (41 rigs), and the SCOOP-STACK of Oklahoma (28 rigs). The DJ Basin of Colorado slipped by one rig, leaving 13.

The rig count in the Marcellus Shale largely in Pennsylvania (32 rigs), the Bakken Shale of North Dakota/Montana (24 rigs) and the Utica Shale mostly in Ohio (13 rigs) remained the same week on week. It was the fourth straight week the Utica rig count remained at the same level.

Rig counts in the Haynesville, a natural gas-prone play, generally had been ticking up all this year in step with gas prices.

That area’s rig count cracked 50 in late April 2021, higher than it had been even at the start of 2020, and reached a high of 57 for the week ending Aug. 11. But since then the play’s rigs have slipped by five after gas prices ticked down in mid-August.

But gas prices were up slightly on week, according to S&P Global Platts. Henry Hub average prices for the week ending Aug. 25 were up 1 cent to $3.93/MMBtu, while Dominion South prices averaged $3.62/MMBtu, up 7 cents.

Crude prices, however, continued to fall after hitting recent mid-$70s/b peaks in July. WTI averaged $65.58/b, down $1.79; WTI Midland averaged $65.98/b, down $1.56; and the Bakken Composite averaged $64.78/b, a drop of $1.88.

Delta peak at hand in US?

While the path of commodity prices is uncertain in the near term and the market has become increasingly concerned over refined product demand amid resurging cases of coronavirus’ delta variant, underlying fundamentals remain “attractive,” investment bank Morgan Stanley said.

“Total oil inventories have continued to draw and now sit near five-year lows, capital discipline is holding within US shale (limiting supply growth), and Morgan Stanley oil strategist Martijn Rats expects OPEC+ to remain supportive of market prices” and to manage oil prices through 2022, an Aug. 23 investor note said.

The bank said a “sizable deficit” in oil inventories are expected for second-half 2021, with all those factors supporting Rats’ view of mid- to high-$70/b Brent in a supply- constrained environment.

Moreover, the delta wave peak in the US “may be approaching,” Morgan Stanley said.

“Based on the reproduction rate trajectory, US/UK hospitalization relationship and previous peaks, Morgan Stanley’s biotech analyst Matthew Harrison expects the current wave in the US to start to decline in late August or early September,” the bank said.

“If the UK is any indication, mobility data (and gasoline demand) in the US is likely to rebound following the peak in infections. In China, the second-largest oil consumer after the US, Covid cases have also begun to roll over in recent days.”

In addition, the oil services and equipment side of the energy industry is showing greater visibility into customer plans for the first time in several years, said James West, an analyst with Evercore ISI.

“Visibility … is also extending into 2022,” West said in an Aug. 19 note. “The fundamental backdrop remains positive with supportive commodity prices, structurally lower cost structures in place, inflationary pricing recovery starting to take hold, and activity and utilization levels moving higher globally.

“We continue to believe that a multiyear upcycle is starting to unfold,” he added.

Source: Platts

Source: Platts