The US oil and gas rig count surged by seven to 624 on the week, energy analytics and software company Enverus said Aug. 19, amid uncertainty over crude prices that have tumbled from the plus-$70/b perch that had given producers a shot of much-needed confidence over the last few months.

Analysts who routinely spoke with upstream operators after the recent round of second-quarter earnings calls appeared to sound a hint of worry.

“Economic recoveries have slowed and mobility and oil demand indicators have fallen,” Standard Chartered Bank analyst Paul Horsnell said in an Aug. 17 investor note. “Our balances now show a smaller supply deficit in June and July than previously calculated. We now expect small surpluses in August and September followed by small deficits in October and November.”

“Our data cautions against the consensus view that the tightness once forecast for Q3 has merely been delayed,” Horsnell said. “In our view Q4 oil market balances are not tight, and the 2022 balance is now oversupplied to an extent that will likely cause OPEC+ to pause its schedule of monthly supply increases early in the new year.”

In the past couple of weeks, oil prices have dropped amid an unexpected build in US gasoline stocks and as the coronavirus delta variant continued to stymie demand.

According to S&P Global Platts, both oil and gas prices dropped nominally for the week ended Aug. 18.

NYMEX WTI averaged $67.37/b, down 90 cents, while WTI Midland averaged $67.54/b, down 84 cents. Natural gas decreases were less steep, with Henry Hub prices averaging $3.92/MMBtu, down 21 cents and Dominion South $3.55/MMBtu, down 17 cents.

NYMEX WTI had been in the mid-$70s/b during some of June and July.

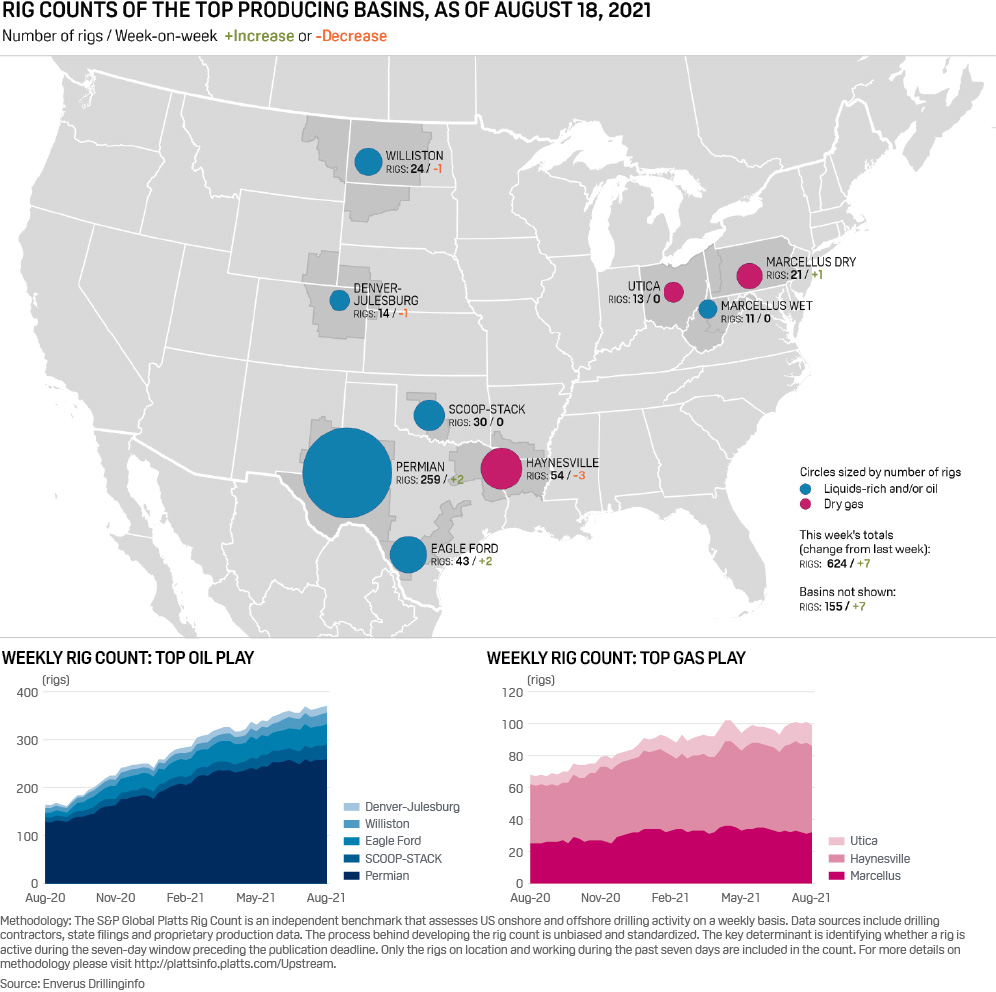

Despite the price signals, the US rig count is at its highest level since early April 2020, as is the oil rig count with 479, up five on the week. Also, the natural gas-directed rig count was up two to 145; gas rigs are now the highest they’ve been since late February 2020.

Even so, individual basin activity was somewhat sluggish in the past week.

The largest single shift came from the gas-prone Haynesville Shale in East Texas/Northwest Louisiana, which lost three rigs on the week to 54, while the Bakken Shale of North Dakota/Montana and the DJ Basin of Colorado each lost one rig. The downticks brought those basins’ totals to 24 for the Bakken and 14 for the DJ.

However, the Permian Basin of West Texas/New Mexico and the Eagle Ford Shale of South Texas each added two rigs, bringing their respective totals to 259 and 43, while the Marcellus Shale mostly in Pennsylvania was up by one rig to 32.

The SCOOP-STACK play of Oklahoma and the Utica Shale of Ohio remained unchanged on the week at 30 and 13 rigs respectively.

In general, rig additions to fields occur after decisions by E&P operators two to three months prior, so that weekly rig numbers often don’t reflect current market conditions. As a result, many analysts dislike commenting on the week-to-week rig landscape.

E&P discipline is no secret

But the current landscape isn’t all bad for producers. E&P companies have made no secret of their disciplined spending mindset and during Q2 pledged to remain at 2021 capital budgets set early in the year. And a large number of E&Ps are still budgeting based on a $55/b oil price, and some at an even lower price.

Jim Wicklund, manager of energy investment banking for Stephens, said his firm estimates Q3 2021 spending will increase 5% sequentially “based on E&P guidance.”

The gain of 218 oil and gas rigs so far year – which raised the domestic rig count more than 50% from early January – stemmed from a need to maintain production or even increase it a few percent, after drilling activity plummeted in early March 2020 as the coronavirus pandemic spread rapidly throughout the world, tamping down oil demand and crude prices.

After oil prices hit $70/b in early June 2021 and stayed there, Wall Street widely expected capital budgets would rise next year. Evercore ISI Group analyst James West cited a 20% increase in North America and 15% globally in 2022.

And even though privately held US upstream operators have been an unknown quantity when forecasting production growth, West does not believe they will ultimately carry much weight.

Private operators, which have accounted for a sizeable tranche of rigs added to the active fleet in 2021, are viewed by some as a “wild card.” Some experts are concerned privates might feel free to produce all-out while larger public companies – which have pledged to restrain spending – look upon on them enviously.

However, “the specter of private E&Ps undermining restraint in North America and forcing the hand of OPEC+ is muted in our view, with not enough privates having high-quality resource and financial means to move the needle in a major way,” West said.

Source: Platts