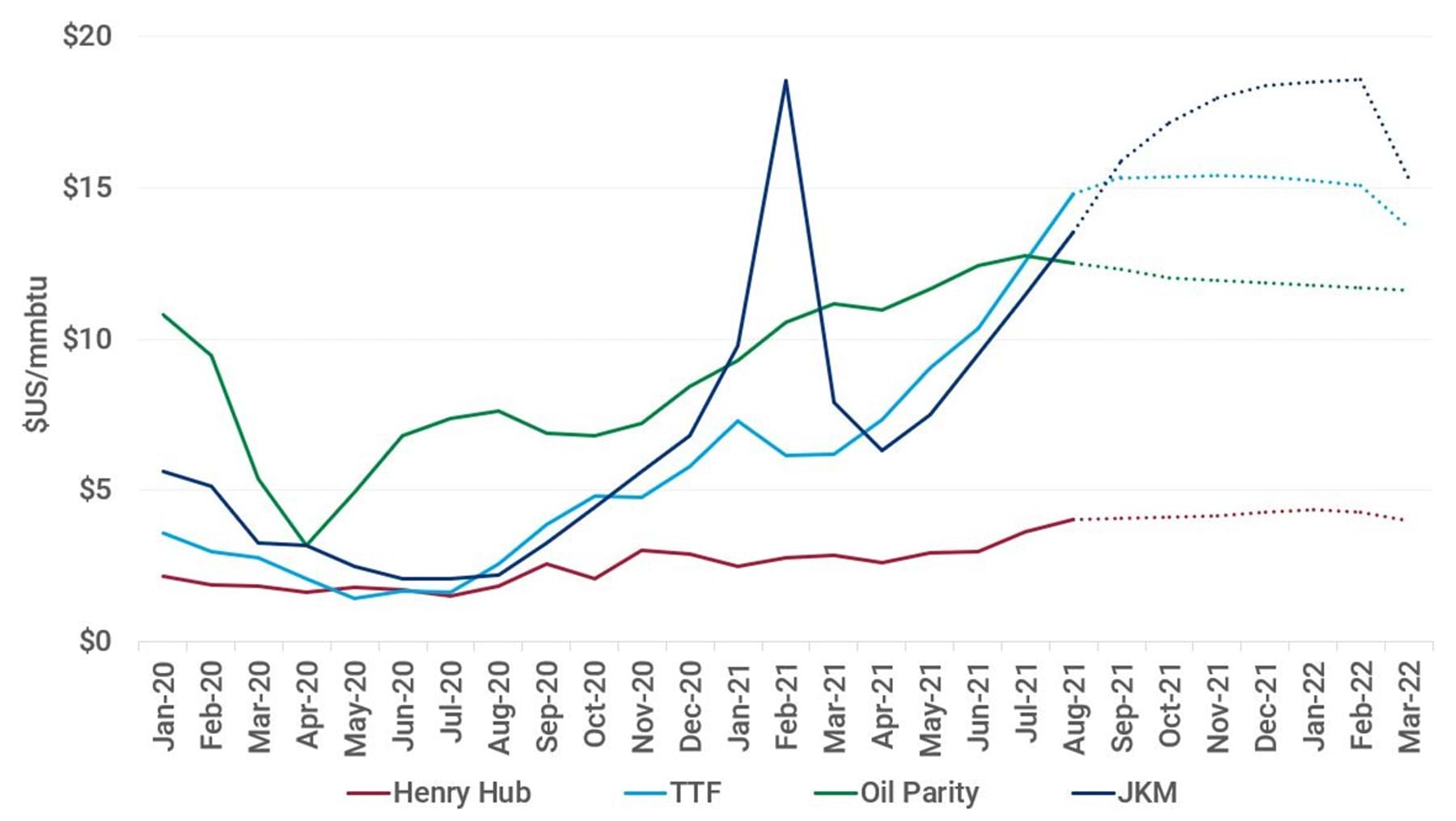

Global gas prices are rallying significantly this summer. Over the last couple of weeks, peak European TTF winter forward prices continue to set new record highs eclipsing US$15/mmbtu, even surpassing oil parity.

Henry Hub gas prices that plumbed lows of US$1.50/mmbtu this time last year have also surpassed well above US$4/mmbtu. Is there a growing Henry Hub winter gas price risk?

Global gas prices have rallied

Source: CME settles as of 10 August 2021. For Wood Mackenzie’s fundamental forecast prices, refer to our Global LNG Short Term monthly outlook.

Reduced room for error in gas supply-demand balance

In our latest North American Gas Market outlook, the coming winter is projected to end with around 1.3 trillion cubic feet (tcf) of gas storage in the ground in the US L48, assuming normal weather. This indicates that all gas currently modeled to be available for storage prior to the winter will likely be needed. European storage is also well below the five-year average, with some uncertainty remaining for Nord Stream 2 timing. Asian secular gas demand continues to grow, despite the impact of the Delta variant of Covid-19.

It’s safe to say there is uncertainty going into the winter, and gas will be needed in all the major demand regions of the world with less room for error than normal.

Balancing the gas market in the US

In the US the main levers for balancing the market are also different than normal.

- US gas production is somewhat muted by capital discipline. Cash is being used to pay down debt and strengthen balance sheets rather than drill and complete wells, calling into question remainder of 2021 and 2022 growth.

- Coal-to-gas switching is also outside the range of normal. This calls into question the limits of how much coal can ramp if economically incentivized, after so many years of reducing coal capacity.

- Finally, LNG exports are full throttle, with very wide US-to-Asia and US-to-Europe arbitrages. However, Northeast basis markets for winter are already pricing up to compete for winter LNG.

Could this create a perfect storm should a particularly cold winter hit the US, and more so as northern hemisphere winters are often correlated? Certainly, one would have to ask if the lag time for adding new production and potential limits to coal-to-gas substitution observed this year would lead to a situation where LNG exports would need to be held back in the US. It’s an outside scenario, but one with many implications, and elements we can help you monitor.

North America gas markets are dynamic and fast moving. Plan ahead and keep up with critical comprehensive integrated forward market research and real-time verification. Contact us using the form on this page if you would like to speak with our experts or explore our short-term offerings.

Source: Wood Mackenzie